|

Monday, March 12 2018

Thursday, March 01 2018

8% yield sounds pretty good - but HIgh Yields can be short lived... Friday, February 23 2018

Brisbane expected to grow by 1.8 million (60,000 people a year) to 4 miilion over the next 30 years taking it to the size of Melbourne today... Thursday, February 22 2018

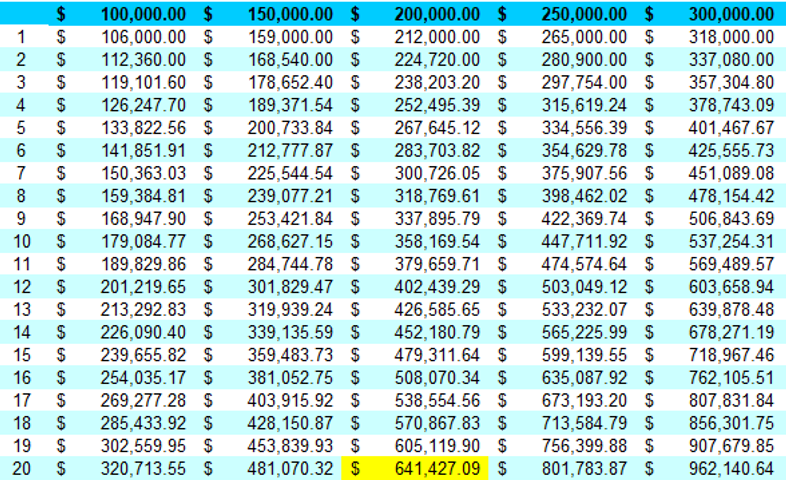

I received a really good question about my post yesterday on projecting retirement income and whether you would end up on the aged pension. Link to article here if you haven't read. In the article I had a table showing projected Super balances based on achieving an annual growth rate of 6%. Based on the example used if you had a Super balance of $200,000 today. You could expect to achieve a balance in 20 years’ time of $641,427. Invested at 4.5% returns that would give you an annual income of $16,500 a year allowing for the effects of inflation. The question was that the calculations didn’t allow for Super Contributions over the 20 years. The chart actually does. It assumes a growth rate inclusive of contributions. Just because contributions are made to Super does not mean a super balance goes up. Super is not like saving unless you are 100% invested in cash. Your balance is not capital protected as many retirees found out during the GFC. If you refer to the chart above this shows the growth rates of a leading Industry Super Fund (According to their TV Ads supposedly superior funds) over the last 10 years to June 2017. You will notice the fund had some fairly significant periods of negative growth particularly during the GFC and the following aftermath. At this point people were paying money into their Super but seeing balances decline. Even in the last few weeks people’s super balances have been declining even though they were making contributions. Because the market has taken a hit. The other thing to remember is Super also has deductions - tax, fees and insurance. The 10-year average return for the above fund was 4.18%. I don’t doubt there are funds that have performed better than this but given the share market hasn’t even got back to it’s pre-GFC high I think 6% is being fairly realistic. But for arguments sake I could make the growth rate 8%. This would only get you to $932,000. Still leaving a shortfall of over $1.7 million. I’m not here to bag Super. That’s not the point of my article. What I am here to highlight is that for most Australian’s, their Super is not going to be enough. It’s part of the mix but it’s not the complete answer. My concern is many Australians really don’t understand how way off track they are. Which means if you want to be in a better position you need to have additional strategies in place. In fact, an interview I heard this morning on the ABC again highlighted this issue. If I can get a transcript or link I’ll get this posted. Really good question and welcome questions and debate. If you would like to do something about it then Click here to Book in for a FREE telephone appointment with me and we can talk about the steps you can take to start tackling it. Tuesday, February 20 2018

6 out of 10 Australians believe they will fall short of the amount of money needed to live a comfortable retirement. Are you one of them? STEP 1 - Work out how much super will you end up with?

For example if you currently had a Super balance of $200,000 and had 20 years until retirement your final Super balance would be $641,427. So what sort of income would that give you?...Let's go to the second chart STEP 2 - How much do you need in your retirement fund to earn a certain income?

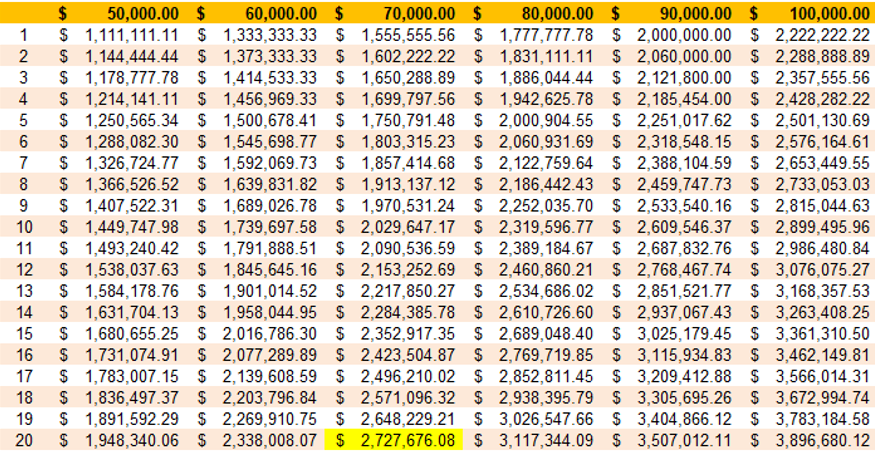

The above chart shows the amount of investment assets less any debt you would need to hold to receive a certain income in retirment based on acheiving a 4.5% return. For example if you wanted an income of $70,000 by the time you retire in 20 years time you would need $2.72 million in investment assets. How much income do you need in retirement? A general rule of thumb is that to maintain you current lifestyle in retirement you would need an income of approximately 70% of your annual income today. So if you were earning $100,000 today you would need $70,000 in retirement. In 20 years time if your Super was $641,000 you would earn a measely $16,500 a year. Which means if you want to earn $70,000 you need to build an extra $2.086 million into your retirment fund over the next 20 years. Or to think of it another way - you need to add $104,000 every year for the next 20 years. Something tells me salary sacrificing an extra $100 a week into super isn't going to get you there. I understand most Australians are fearful about investment and taking risk and what could go wrong etc etc but how is doing nothing less of a risk or less scary? If you would like to do something about it then Click here to Book in for a FREE telephone appointment with me and we can talk about the steps you can take to start tackling it. Monday, February 19 2018

If you have concluded that you will have an investment shortfall by the time you retire and that you are going to use property to help bridge that gap. Then your next critical step is to confirm you can get the money to buy an investment property. There is little point researching property, investigating various suburbs and going to open homes if you don’t know what your purchasing capacity is. Knowing exactly what your purchasing capacity is going to make it much clearer where you can afford to look and start to narrow down your options. Which means you will need an understanding of what you can borrow. This might seem obvious but you would be surprised how many people skip this step. In the current lending environment it would be a mistake to assume you will qualify. In recent times lenders have made some fairly significant changes to lending policy which has had a negative impact on peolpes The key factors that will influence your ability to borrow for property are going to be:

Importantly it is not sufficient to just have a good surplus income or good equity in your home. You need to tick both boxes to qualify for further lending. It is essential that you have your borrowing capacity properly assessed by an experienced professional before you go looking for property and certainly before you put a contract on a properly. By properly assessed I mean a full review of your paperwork – payslips, saving statements, loan statements etc. Using online calculators on lender websites or just handing over some brief details over the phone to a lender is highly unreliable. If you were pre-approved 3 or more months ago don’t assume that you still have finance. Lenders policies change regularly and have changed significantly in the last 12 months. Also, your circumstances may have changed which may now impact your borrowing capacity. Need to arrange a finance assessment? I look forward to talking with you Monday, February 19 2018

There is a saying in law that a person who chooses to represent themselves has a fool for a client. The same could be said for a landlord who self-manages their investment property. I’m sure there are some people who do it effectively but from my experience it is a false economy. In trying to save a few dollars in management fees a landlord could be giving up much more resulting in an under-performing property. There are many reasons why an experienced property manager will achieve a better result for your property than you can Performance Keeping it business not personal The other classic self-management example is renting to friends or family – a major mistake. What are you going to do when they don’t pay rent, damage the property or its time to increase the rent and they cry poor. A good manager will get you rent increases when the market permits and still keep a tenant on long term. Market knowledge Screening tenants Legal requirements Repairs and maintenance Tax deductible Time If your property was rented for $400 and your manager charged 8.5% plus GST then you would be paying $37.40 a week. If you had to spend 3 hours a week on average managing your property that's $12.46 an hour. Surely your time is worth more than that? It’s possible to achieve good returns and cashflow with investment property without trying to self-manage. Book in for a FREE telephone appointment with me and we can discuss how you could achieve this. Book your FREE appointment now. I look forward to talking with you Friday, February 16 2018

Wednesday, February 14 2018

In addition to saving a deposit or using equity in an existing home you also need to allow for a range of costs when purchasing a property. When added up these costs can range between 4% to 7% of the purchase price. Saturday, February 10 2018

This week’s market volatility provides a good opportunity to reflect on investment attitudes that apply across any investment class including property. |