Tuesday, May 27 2025

If you grew up in SEQ, this might take you back…

Heading south on the old Pacific Highway:

First on the right — Bullen’s Lion Safari at Beenleigh.

Actual lions. In paddocks. In Queensland.

Then a bit further down, on the left — that flying saucer-shaped servo at Yatala, home to the Lions Club pancake house.

Beyond that? Not much.

Just open road until you hit Southport.

Fast forward to now?

That whole stretch is wall-to-wall housing, warehouses, and one of the busiest stretches of road in Australia.

Wouldn't it be good to find the next Yatala?

Wasn’t that long ago Plainlands was a blink-and-you’d-miss-it spot between Toowoomba and Brisbane.

Now?

-

Bunnings and Woolies are up and running

-

Aldi and Supercheap Auto have moved in

-

Two private schools with over 1,000 students enrolled

-

UQ Gatton campus just down the road — a major ag and vet science hub

-

Zoning in place for major retail and industrial growth

-

Vacancy rates are tight and yields are strong

-

And the Warrego Highway puts it within easy reach of both Brisbane and Toowoomba

Which is why I wanted to let you know about this dual-income property:

And with financial markets pricing in another rate cut in July, this could be a smart time to be looking ahead.

Go here to find out how you can get access this and other off-market opportunities

Monday, May 26 2025

This one's got all the right ingredients…

High rental return. Growth location. Dual-income design.

Here’s a quick snapshot:

Dual-Income Property – Moreton Bay Region

Rental appraisal: $1,100/week combined

Land near registered

? Prime Location

• 135m from State School

• 193m to Medical Centre

• 1km to Train Station

• 1.1km to new Satellite Health Centre

• 2.5km to North Lakes Shopping Centre & IKEA

• 3km to University

? Strong Fundamentals

• 0.7% vacancy rate = tight rental demand

• 6.2% capital growth already this year

• Dual-income setup = cashflow + flexibility

• High-growth corridor in SEQ

These sort of opportunities disappear pretty quickly.

Go here to find out how you can get access this and other off-market opportunities

Friday, May 23 2025

When it comes to property investing, most people put 90% of their focus on the property…

And barely a thought into how they structure their finance.

But here’s the truth:

The wrong finance setup can cost you tens of thousands in lost deductions, extra repayments, or worse — completely block you from growing your portfolio.

So what should investors do instead?

Let’s break it down.

? What matters most is having the right structure from day one.

That usually means keeping your investment lending separate from your home loan, using interest-only where it makes sense, and avoiding cross-collateralisation unless there’s a very good reason.

? Why does this matter?

Because the right structure gives you flexibility, protects your borrowing capacity, and lets your money work smarter — not harder.

It can be the difference between owning one property… or building a portfolio that actually sets you up for financial freedom.

? And here’s the bit most people miss:

If you go straight to your bank, they’ll often try to shoehorn you into a structure that suits them — not you.

That can mean tying all your loans together, locking you in, and potentially blocking your future plans.

Worse, it could slow down your progress on paying off your home.

That’s why we always start with strategy first.

Before you buy anything — get your finance game plan sorted.

If that’s something you’ve been meaning to do, I’d recommend booking a 30-minute Investment Game Plan Call with me.

We’ll look at where you’re at now, where you want to be — and whether your finance setup is helping or holding you back.

? [Book your call here]

Cheers,

Greg

More Than Accountants

Friday, May 23 2025

If you haven’t been paying close attention, hearing someone mention Bundaberg as a place to invest might raise an eyebrow.

Seems a bit… off the radar.

Regional town. Rum, beaches, sugar cane.

Nice place for a weekend away — but to build wealth?

Most people's first instinct would be to move on.

But if they dug a little deeper they would probably learn a few things they didn't know.

-

It has the Second fastest economic growth in Queensland (7.1% in one year)

-

$4.2B in infrastructure committed over the next decade

-

Population forecast to grow 36% by 2040

-

Strong job growth and a push into health, education, renewable energy and advanced manufacturing

-

Their are major upgrades to hospitals, highways, marine facilities, and even an aerospace precinct

Here’s a recent example I came across that highlights the shift:

-

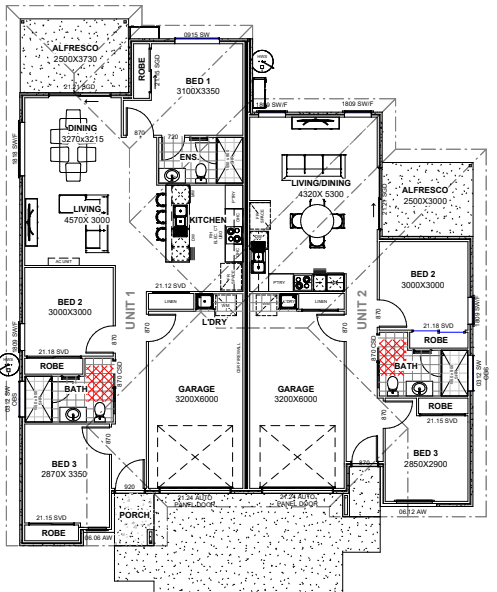

Dual-key home on a registered 900m² block

-

Unit 1: 3 bed, 2 bath, 1 car

-

Unit 2: 2 bed, 1 bath, 1 car

-

2550mm ceilings

-

Total package: $844,594 Full turnkey

-

Estimated rent: $970 per week

If your approach was purely property and location then you wouldn't even see this.

Not saying Bundaberg is right or wrong for you.

But when you focus on strategy first — meaning where you want to be financially over the next 10–15 years — instead of putting the blinkers on about where or what to buy, it opens up more options.

Go here to find out how you can get access this and other off-market opportunities

Thursday, May 15 2025

I understand if you’re feeling like the market has moved on without you.

You keep hearing about dual income deals with great yields...

But everything that looks good is either out of budget, or gone before you even get your finance approved.

So when I came across this one, I knew I had to share it.

Brand new Dual income

$782,000

7.3% yield

224m² dwelling

Full turn-key

The plus is — it’s in the Toowoomba region.

Why does that matter?

Toowoomba’s $15.37B economy is continuing to go from strength to strength.

And it's about to become a major energy hub for SEQ with tow major projects in the pipeline.

1. Big-T Pumped Hydro Project – $1.65B investment near Lake Cressbrook.

2. Tarong West Wind Farm – 436.5MW project, 230,000 homes powered, backed by Stanwell and RES

Both these projects will unlock more wind and solar development across the Southern Renewable Energy Zone

This is the sort of thing you can miss if your not plugged into the right networks.

Go here to find out how you can get access this and other off-market opportunities

Wednesday, May 14 2025

Many of my clients are using dual-income property just like this one.

Not just to build wealth — but to knock years off their home loan.

Two birds. One smart property.

More income means an easier hold, less financial stress, and the potential to drive down your home loan without changing your lifestyle.

This property has a lot of the pieces that make that strategy work.

In case you didn’t know, Toowoomba is a $14.76 billion economy, growing at over 6% a year and supporting more than 93,000 jobs.

Infrastructure, education, logistics — it’s all happening. And this property sits in a suburb with strong tenant demand and serious family appeal.

Here’s what’s around the corner:

• 300m to a private school

• 300m to childcare

• 5km to Toowoomba CBD

• 10km to Wellcamp Airport

Here's the breakdown

- 5 bed | 3 bath | 2 car

- 680m² block | 200.3m² build

- $946,600 turnkey

- Expected rent: $1,030/week

- Registration expected July 2025

High yield + high land content = cashflow and growth.

Go here to find out how you can get access this and other off-market opportunities

Monday, May 12 2025

Want a New Build —But don't want to wait?

This rare 6-bedroom, dual-key has come up in one of South East Queensland’s fastest-growing pockets. With services and employment in easy reach.

-

1.6km for Beaudesert High School

-

1.2km to Business Park

-

3.2km from Beaudesert Hospital

-

3.4km from Scenic Rim Council HQ

The Scenic Rims population is expected to exceed 67,000 by 2041, necessitating the development of approximately 11,000 additional dwellings.

? Quick Property Snapshot

-

Location: Beaudesert

-

Price: $998,500 (Single Contract)

-

Land Size: 480m²

-

Build Size: 239m²

-

Total Bedrooms: 6

-

Dwelling 1: 4 Bed | 2 Bath | 1 Living | 1 Car – Est. Rent: $575/week

-

Dwelling 2: 2 Bed | 1 Bath | 1 Living | 1 Car – Est. Rent: $475/week

-

Combined Rent: $1,050/week

Go here to find out how you can get access this and other off-market opportunities

Wednesday, May 07 2025

Registered Land | Build-Ready | Dual Income Opportunity in Loganholme

This dual-income is on registered land, no waiting around for titles.

With demand strong and infrastructure continuing to improve across the Logan region, this property is perfectly positioned for investors looking for great yield, low vacancy, and dual income potential.

The Highlights:

- Land size: 584m²

- Status: Registered and ready to build

- Turnkey dual key home – two incomes under one roof

- Rental – Estimated at $1,160/week

- Great location – close to schools, shops, and transport

- Price – $976,488

Ready to Make Your Move?

If this property caught your eye — or if you're serious about finding the right investment — the next step is simple.

Go here to find out how you can get access this and other off-market opportunities

Tuesday, April 29 2025

Single Contract | Registered Land | Build Starts June | Estimated Rent $1,300/week

This is a full turnkey duplex on a large 800m² registered block in Ipswich.

This is a single contract purchase, with construction kicking off in June and completion expected by December.

Each side includes:

With a combined expected rental return of $1,300 per week, this property offers both strong yield and long-term growth in a location with increasing demand.

At a glance:

- Single contract – simple, straightforward purchase

- Registered land – ready to build

- Build starts: June | Completion: December

- 10% deposit

- High rental yield: $1,300/week est.

- Price - $1,195,000

Dual Income, One Title

Boost your rental income without doubling up on land costs.

Tax Depreciation Benefits

Brand new build means solid depreciation claims (check with your accountant).

Minimised Vacancy Risk

Two tenancies provide more stability—even if one side is vacant, you’re still earning.

Flexible Exit Strategy

Rent both, or potentially strata-title down the line (subject to approvals).

Go here to find out how you can get access this and other off-market opportunities

Saturday, April 26 2025

Here’s a dual occupancy opportunity that ticks a lot of boxes — and it’s already under construction. Located in the popular Waterlea Estate, Walloon, this single-contract property offers a great mix of strong rental potential and long-term growth, all for $975,500.

Property Snapshot

Land Size: 350m²

Total Build Size: 238m²

Contract: Single

Status: Under Construction

Occupancy 1 (Main Dwelling)

-

4 Bedrooms

-

1 Living Room

-

2 Bathrooms

-

1 Lock-up Garage

Occupancy 2 (Secondary Dwelling)

-

1 Bedroom

-

1 Living Room

-

1 Bathroom

-

1 Lock-up Garage

Great for cash flow and depreciation — and with the build already underway, you won’t be waiting 12+ months to see returns.

Why Waterlea Estate, Walloon?

-

Proven Demand: Nearly 100 lots snapped up in the first release

-

Master-Planned Community: 34 hectares of parklands, walking trails, and open green space

-

Everyday Convenience: Close to schools, shops, IGA, medical centre, and Walloon train station

-

Easy Access: 12 mins to Ipswich, 45 mins to Brisbane via the Warrego Hwy

-

Local Jobs Hub: 10 mins to RAAF Base Amberley – $1.5B expansion = 2,000+ new jobs

-

Growth Forecast: Ipswich population expected to hit 520,000 by 2041

Go here to find out how you can get access this and other off-market opportunities

Friday, April 25 2025

Loganholme Dual Key – $965,350

Registered Land | Build-Ready | Dual Income Opportunity

This dual-income is on registered land, no waiting around for titles.

With demand strong and infrastructure continuing to improve across the Logan region, this property is perfectly positioned for investors looking for great yield, low vacancy, and dual income potential.

The Highlights:

- Land size: 433m²

- Status: Registered and ready to build

- Turnkey dual key home – two incomes under one roof

- Rental – Estimated at $1,095/week

- Great location – close to schools, shops, and transport

Go here to find out how you can get access this and other off-market opportunities

Tuesday, April 22 2025

This could be a more affordable solution if you have been finding yourself priced out of the market when it comes to Dual-income property.

With modern finishes, fixed pricing, and strong rental potential, this Dual-income could suit an investor or a homebuyer looking for some additional income to assist with the mortgage.

At a Glance

Location: Brassall

Land is registered ready to build

Total Price: $939,000

Format: 3+1 Bed

Build: 197 sqm

Land: 462 sqm

Rental Estimate: $800–$870/week

Brassall is a rapidly developing suburb in the Ipswich region, just 5 minutes from the Ipswich CBD and under 45 minutes to Brisbane. Its affordability, infrastructure investment, and growing population make it a standout for long-term capital growth.

Infrastructure & Development

-

Major upgrades to nearby highways (Warrego & Cunningham)

-

New schools, shopping centres, and medical precincts

-

Close to RAAF Base Amberley — Australia’s largest air force base, providing strong rental demand from defence personnel

Go here to find out how you can get access this and other off-market opportunities.

Thursday, April 17 2025

RARE INVESTMENT OPPORTUNITY IN BEAUDESERT

This is an incredibly rare 1-part duplex opportunity in the high-growth region of Beaudesert.

- 800m² of land

-

Priced at $1,050,000 single contract

-

Estimated rental return: $1,200 per week

-

Prime location with consistently low rental vacancy rates

-

Land registration expected in May 2025

This property offers exceptional value in a market that’s rapidly gaining attention from savvy investors—and here’s why:

-

Affordable Property Prices

Entry prices are more accessible compared to Brisbane and the Gold Coast, attracting both investors and homebuyers.

-

Strong Rental Demand

A growing population and workforce are driving solid rental returns—ideal for income-focused investors.

-

Strategic Location

Positioned just over an hour from Brisbane and the Gold Coast, Beaudesert offers seamless access to major employment and lifestyle hubs.

-

Growing Infrastructure

Key projects like the Inland Rail and road upgrades are fuelling future growth and enhancing connectivity.

-

Booming Local Economy

The region boasts a diverse economy with agriculture, commercial growth, and rising employment opportunities.

-

Scenic Lifestyle Appeal

Located in Queensland’s picturesque Scenic Rim, Beaudesert blends rural charm with modern conveniences.

-

Planned Future Development

Ongoing residential and commercial development is expected to drive capital growth for years to come.

-

Strong Community & Amenities

Quality schools, medical facilities, shopping centres, and recreational spaces make it a desirable place to live and invest.

-

Government Support & Investment

Both local and state governments are backing the region with funding and policy support, accelerating its development.

-

Capital Growth Potential

As affordability pushes more people out of metro areas, Beaudesert’s property values are forecast to rise steadily over time.

Go here to find out how you can get access this and other off-market opportunities.

Wednesday, April 16 2025

Logan is the fastest-growing area in South East Queensland, with a population growth rate of 4.05%.

By 2036, Logan’s population is projected to reach approximately 548,000 residents, driving an unprecedented level of infrastructure investment. More than $18 billion in publicly funded projects are already underway — including facilities for the 2032 Olympic Games.

This growth story creates strong demand for quality housing, making this Logan Village dual income property a smart choice for investors.

Logan Village offers the space and serenity of semi-rural living, with the convenience of nearby amenities. Walking distance to the local state school, Woolworths, cafés, and a medical centre.

Just 10 minutes from the highly regarded Canterbury College.

Property Details:

Logan Village

3 + 2 Bedroom Dual Income Home

House size: 209m² | Land size: 511m²

Estimated Rent: $1,000/week

7 Star Energy Rating

Price: $965,900

Land registration is expected August 2025

Go here to find out how you can get access this and other off-market opportunities.

Tuesday, April 15 2025

This is a Brand New Dual Occupancy property currently under construction in Park Ridge. Single contract. Settlement on completion.

- Within 1km of the new State School

- 600m from nearest day care centre

- 400m from local shops

- Close proximity to major employment hub

3 + 2 Bed format

7 Star Energy Rating

House: 230m2

Land: 357m2

Estimate rent $1,050/week.

Price $1,100,500

Go here to find out how you can get access this and other off-market opportunities.

Friday, April 04 2025

New Dual income property in Marsden.

Configuration - 3 Bed + 2.5 Bath + 1 Car & 2 Bed + 1 Bath + 1 Car

Main dwelling with separate living and dining areas and kitchen with walk in pantry.

Land size: 556m2

Estimate rent $1,100/week.

Price $981,000

500m from local school

2.2km from shopping centre

Go here to find out how you can get access this and other off-market opportunities.

Thursday, April 03 2025

Duplex with potential uplift of $224,000 to $324,000.

Located in Marsden in central location:

Marsden State School (1.1km), Marsden State High School (1km). Other nearby schools include: Burrowes State School and St Francis College.

- Marsden Park Shopping Centre only 900m away

- Logan Hospital 11mins away (next to Loganlea Train Station)

Each unit features - 3 Bed + 2 Bath + 1 Car

Land size: 500m2

House: 228m2

Estimate rent $1,200/week.

Registration: Expected May 2025

Price $1,075,787

Go here to find out how you can get access this and other off-market opportunities.

Tuesday, April 01 2025

Dual income property Loganlea - Infill Site

Rare opportunity to secure brand new dual income property in the established suburb of Loganlea.

- Logan Hospital 4.4kms

- Griffith University 4.9kms

- TAFE College 4.8kms

- Logan Railway Station - Linked Brisbane/Gold Coast 3.5kms

- Centrally located with easy access to Logan Motorway, Ipswich Motorway & Gateway Motorway

216m2 House 3+2 Beds on 500m2 block. Expected rent up to $1,140 a week. Priced at $991,015.

Go here to find out how you can get access this and other off-market opportunities.

Friday, February 21 2025

With it's mix of economic and lifestyle factors, and affordability, it is easy to understand why property in the Fraser Coast region is being regularly sought out by investors.

This full-turnkey dual-income property in the heart of Hervey Bay is only 1.6km from the beach, within 350m of the local primary and high schools. 4km form the University and TAFE campuses and 3km from the airport.

The property offers a spacious 225m2 house on a 632m2 block with an expected yield of 6.1%. Priced at $837,812.

The Fraser Coast has been one of the fastest growing regions in Qld for population and employment as a result of business and infrastructure investment.

The population is expected to grow from 117,940 to 144,011 by 2041.

With 17,990 new homes required.

Major projects and investment include:

$7.1B contract to build and deliver 65 next generation trains supporting 800 local jobs.

- $90M Rheinmetall NIOA Munitions (RNM) 155mm artillery shell manufacturing facility in Maryborough supporting the Australian Defence Force.

- The $1 Billion Woondum to Curra project is a new 26km, 4-lane divided highway extension.

- $439 Million Bruce Highway Flood Proofing Upgrade

- $44.1 Million upgrade Maryborough-Hervey Bay Road and Pialba-Burrum Heads Road in Eli Waters.

- $44.66M Upgrade to the Fraser Coast Hospital

- $85.1M for Stanwell to build a 150 megawatt battery for Tarong Power Station.

- $197.2M Munna Creek 250ha Solar PV Park which will generate 250,000MWh to power 30,000 households offsetting 200,000 tonnes of CO2 emissions.

- A new $31 million recycling sorting centre opening in early 2025.

- $60 million Fraser Coast Water Grid to ensure secure, reliable, and affordable water future for the region.

- Planned $100M Hervey Bay CBD Redevelopment

- Completed $24M runway renewal at Hervey Bay Airport and expansion of departure lounge to cater for 180,000 passengers a year.

Go here to find out how you can get access this and other off-market opportunities.

Thursday, February 20 2025

This is a new dual income property priced under $800,000 with a yield up to 6.7%.

With a 216m2 house the property offers plenty of living space for tenants.

The property is located in a master planned community in Toowoomba only 1 min from the local school, 10 minutes to Wellcamp Airport which offers direct flights to Sydney and 10 minutes to the Toowoomba CBD.

Toowoomba is a $14.76 billion economy growing at over 6% a year and supporting 93,206 jobs.

Go here to find out how you can get access this and other off-market opportunities.

|