|

Tuesday, February 20 2018

6 out of 10 Australians believe they will fall short of the amount of money needed to live a comfortable retirement. Are you one of them? STEP 1 - Work out how much super will you end up with?

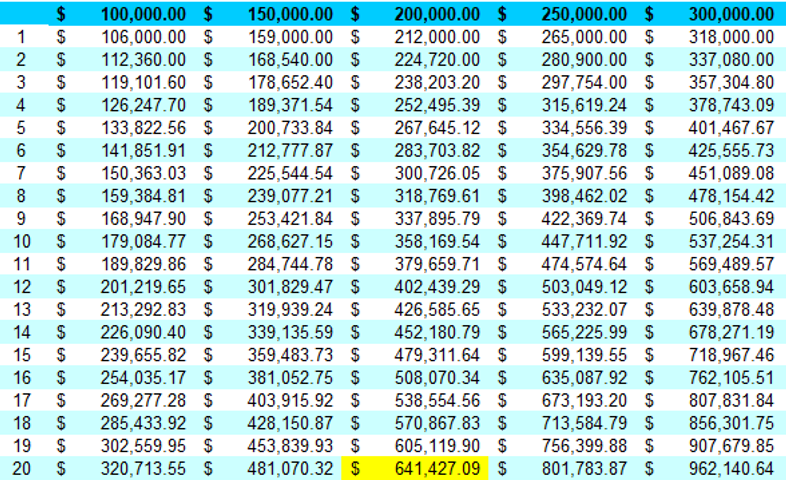

For example if you currently had a Super balance of $200,000 and had 20 years until retirement your final Super balance would be $641,427. So what sort of income would that give you?...Let's go to the second chart STEP 2 - How much do you need in your retirement fund to earn a certain income?

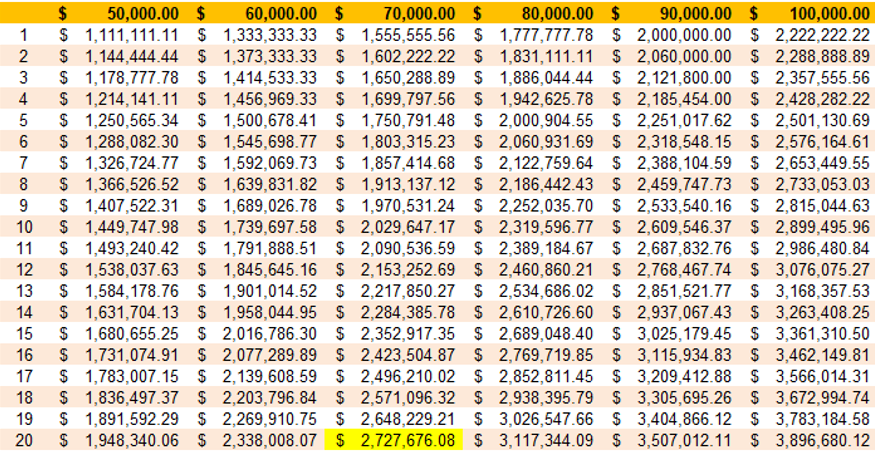

The above chart shows the amount of investment assets less any debt you would need to hold to receive a certain income in retirment based on acheiving a 4.5% return. For example if you wanted an income of $70,000 by the time you retire in 20 years time you would need $2.72 million in investment assets. How much income do you need in retirement? A general rule of thumb is that to maintain you current lifestyle in retirement you would need an income of approximately 70% of your annual income today. So if you were earning $100,000 today you would need $70,000 in retirement. In 20 years time if your Super was $641,000 you would earn a measely $16,500 a year. Which means if you want to earn $70,000 you need to build an extra $2.086 million into your retirment fund over the next 20 years. Or to think of it another way - you need to add $104,000 every year for the next 20 years. Something tells me salary sacrificing an extra $100 a week into super isn't going to get you there. I understand most Australians are fearful about investment and taking risk and what could go wrong etc etc but how is doing nothing less of a risk or less scary? If you would like to do something about it then Click here to Book in for a FREE telephone appointment with me and we can talk about the steps you can take to start tackling it. |