|

Monday, June 18 2018

Did you know that 73% of property investors never get past one property? Correct research and property selection at the outset is vital so your investment plans don't stall. To discuss your investment plans Click here to Book in for a FREE telephone appointment with me..

Thanks Tuesday, April 10 2018

Older units can be seen as a low cost way to get into the market in inner city locations but will they deliver on your longer term investment objectives? Tuesday, April 03 2018

Wednesday, March 28 2018

Wednesday, March 21 2018

Monday, March 12 2018

Thursday, March 01 2018

8% yield sounds pretty good - but HIgh Yields can be short lived... Friday, February 23 2018

Brisbane expected to grow by 1.8 million (60,000 people a year) to 4 miilion over the next 30 years taking it to the size of Melbourne today... Thursday, February 22 2018

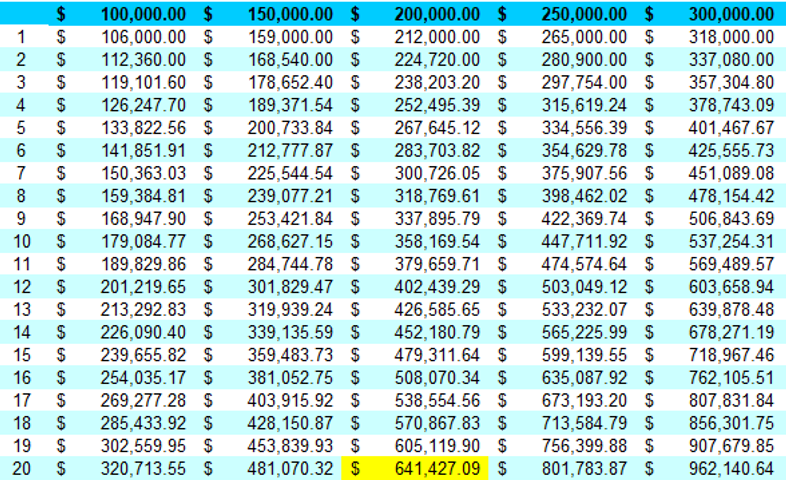

I received a really good question about my post yesterday on projecting retirement income and whether you would end up on the aged pension. Link to article here if you haven't read. In the article I had a table showing projected Super balances based on achieving an annual growth rate of 6%. Based on the example used if you had a Super balance of $200,000 today. You could expect to achieve a balance in 20 years’ time of $641,427. Invested at 4.5% returns that would give you an annual income of $16,500 a year allowing for the effects of inflation. The question was that the calculations didn’t allow for Super Contributions over the 20 years. The chart actually does. It assumes a growth rate inclusive of contributions. Just because contributions are made to Super does not mean a super balance goes up. Super is not like saving unless you are 100% invested in cash. Your balance is not capital protected as many retirees found out during the GFC. If you refer to the chart above this shows the growth rates of a leading Industry Super Fund (According to their TV Ads supposedly superior funds) over the last 10 years to June 2017. You will notice the fund had some fairly significant periods of negative growth particularly during the GFC and the following aftermath. At this point people were paying money into their Super but seeing balances decline. Even in the last few weeks people’s super balances have been declining even though they were making contributions. Because the market has taken a hit. The other thing to remember is Super also has deductions - tax, fees and insurance. The 10-year average return for the above fund was 4.18%. I don’t doubt there are funds that have performed better than this but given the share market hasn’t even got back to it’s pre-GFC high I think 6% is being fairly realistic. But for arguments sake I could make the growth rate 8%. This would only get you to $932,000. Still leaving a shortfall of over $1.7 million. I’m not here to bag Super. That’s not the point of my article. What I am here to highlight is that for most Australian’s, their Super is not going to be enough. It’s part of the mix but it’s not the complete answer. My concern is many Australians really don’t understand how way off track they are. Which means if you want to be in a better position you need to have additional strategies in place. In fact, an interview I heard this morning on the ABC again highlighted this issue. If I can get a transcript or link I’ll get this posted. Really good question and welcome questions and debate. If you would like to do something about it then Click here to Book in for a FREE telephone appointment with me and we can talk about the steps you can take to start tackling it. Tuesday, February 20 2018

6 out of 10 Australians believe they will fall short of the amount of money needed to live a comfortable retirement. Are you one of them? STEP 1 - Work out how much super will you end up with?

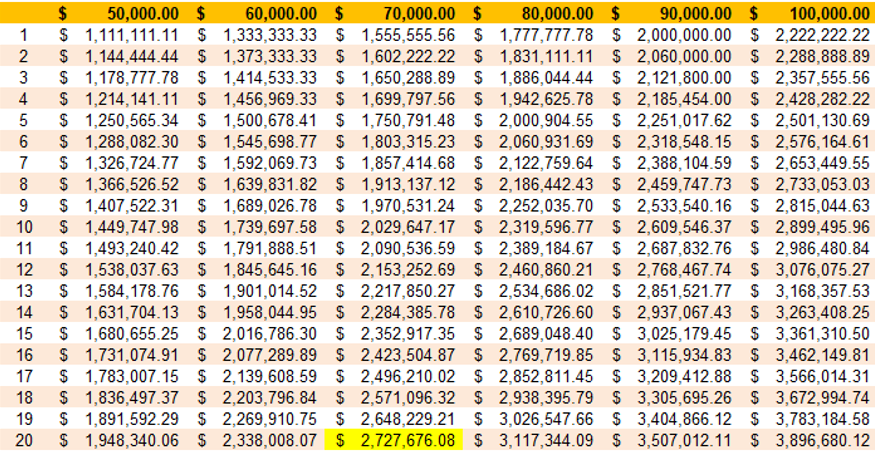

For example if you currently had a Super balance of $200,000 and had 20 years until retirement your final Super balance would be $641,427. So what sort of income would that give you?...Let's go to the second chart STEP 2 - How much do you need in your retirement fund to earn a certain income?

The above chart shows the amount of investment assets less any debt you would need to hold to receive a certain income in retirment based on acheiving a 4.5% return. For example if you wanted an income of $70,000 by the time you retire in 20 years time you would need $2.72 million in investment assets. How much income do you need in retirement? A general rule of thumb is that to maintain you current lifestyle in retirement you would need an income of approximately 70% of your annual income today. So if you were earning $100,000 today you would need $70,000 in retirement. In 20 years time if your Super was $641,000 you would earn a measely $16,500 a year. Which means if you want to earn $70,000 you need to build an extra $2.086 million into your retirment fund over the next 20 years. Or to think of it another way - you need to add $104,000 every year for the next 20 years. Something tells me salary sacrificing an extra $100 a week into super isn't going to get you there. I understand most Australians are fearful about investment and taking risk and what could go wrong etc etc but how is doing nothing less of a risk or less scary? If you would like to do something about it then Click here to Book in for a FREE telephone appointment with me and we can talk about the steps you can take to start tackling it. |