|

Thursday, January 11 2024

A major frustration for property investors is having to reset their interest only investment loan every 5 years. If you have an investment loan you would be aware that most lenders only allow an interest only period of 5 years. After that it automatically converts to principal and interest repayments. Which can see your repayments jump by 20-30%. The only way to get your loan back on interest only is to go through the whole application process again with your current lender or try to refinance. Given the series of rate rises we have experienced this has become very difficult for many investors. The beauty of this loan is the IO period is 40 years. No reviews. No need to make additional payments. At expiry you can either pay the loan out from super or other funds or sale of the property. This means you have extra cash for other things like paying down your home loan, putting extra money into super, or even funds for another investment. Friday, April 24 2020

Wednesday, February 06 2019

Apartments and townhouses will no longer be developed in Brisbane’s suburbs zoned low-density residential. The call to “protect the Brisbane backyard” triumphed, with a vote passed by Brisbane City Council to remove provisions allowing for multiple dwellings on blocks of more than 3,000 square metres. Read full article here Wednesday, January 30 2019

Three non-major lenders have announced reductions to their mortgage rates of up to 32 basis points, despite out-of-cycle rate increases from competitors. If you are not relooking at your lending you are paying too much. If you want to start making some savings I have opened up my calendar for a FREE telephone appointment to see what you could save. Make a time with me now for an initial 10 minute telephone chat. Monday, January 28 2019

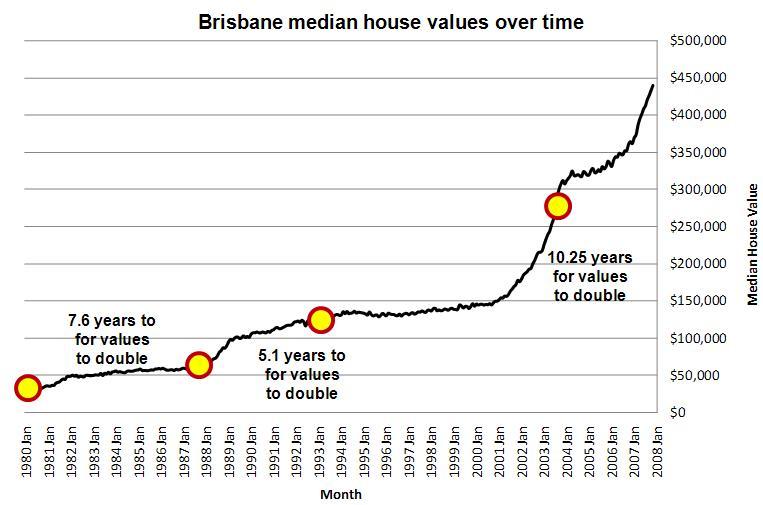

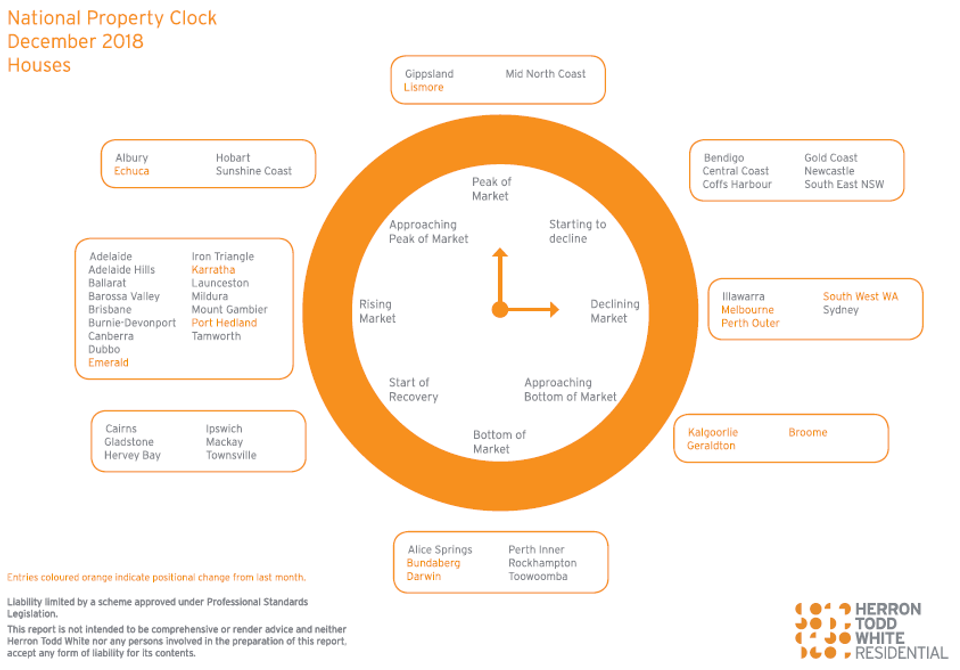

Brisbane came out on top among the strongest performing capital cities in Australia in 2018, simply because its growth remained positive. As prices tumbled in Sydney and Melbourne, Brisbane’s housing market continued its well-worn path of solid, modest growth. By December, Domain data showed the median house price had increased to $670,000. Read full article here Wednesday, January 23 2019

Tuesday, January 22 2019

New data from Queensland’s ports shows coal exports have hit a new high. Total coal exports for 2108 were 223 million tonnes (mt) surpassing the previous record by 2 mt set in 2016. The results demonstrate the coal industrcy remains a significant contributor to the states economy. Read full article here Monday, January 21 2019

Queensland’s population is expected to hit 5.789 million by 2027 and 6.693 million by 2042. Currently sitting at just over 5 million that means nearly 800,000 people (or nearly 89,000 a year) over the next 9 years.

Tuesday, January 15 2019

Solid economic fundamentals have positioned many of Queensland’s residential real estate markets for a good year ahead, with steady demand growth forecast due to rising population, improving employment rates and better lending conditions. Read the full article here Friday, January 11 2019

BRISBANE’S housing market has recorded the strongest annual rise in rents in three years. The latest CoreLogic data by realestate.com.au shows house rents increased 2.4 per cent in 2018, while the cost of leasing a unit became 2.6 per cent more expensive. With a pull back in development projects and an additional 66,500 new residents into the South East per annum this presents more good news for landlords seeking to increase yields. Particularly while the Brisbane market remains affordable.

|