I’m certainly not suggesting we aren’t in challenging times but as each day goes on, I’m struggling to see the dire predictions for the property market that some doomsayers have forecast.

Queensland just recorded another day of zero new virus cases. Already steps are in place to unwind restrictions.

Could I see a correction? Sure. But a crash? That’s getting harder to see.

Particularly for Brisbane.

There’s a number of reasons I say this.

The Recession we had to have

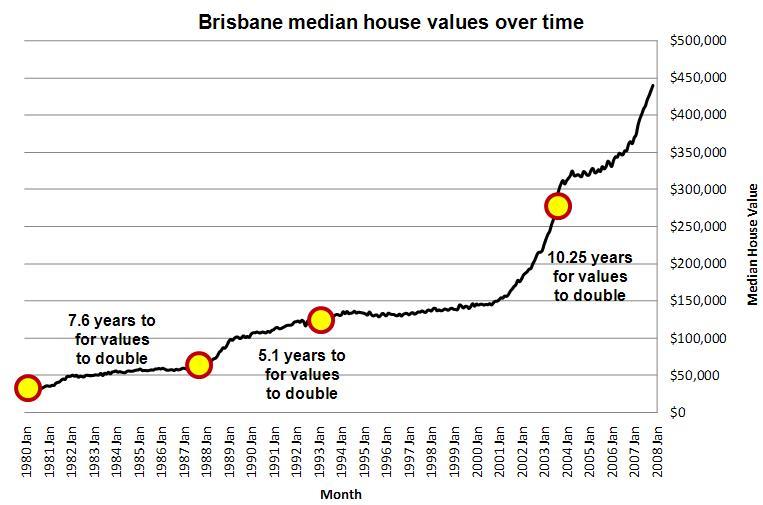

We have been here before and under worse circumstances.

In the early to mid-90s Australia went into recession with unemployment exceeding 10% (similar to what is now predicted)

But how did the property market respond?

It definitely dipped. But not for long. And certainly not a crash.

There are also a couple of factors to note about that period

- Home loan rates reached 17.5%

- Lenders didn’t offer borrowers the opportunity to defer repayments for 6 months. If they didn’t pay they sold them up.

- There was no policy to provide rent relief for tenants

- The government of the day did little at the time in terms of stimulus and when they finally did act it was too little and too late

Surprisingly Governments and banks have learnt from the past

In the current environment:

- there are home loan rates at close to 2%

- the Federal Govt is throwing approximately $300 billion at the economy so far with more likely to come.

- Having had its AAA rating reaffirmed means it can basically borrow at close to 0%

- Many lenders are allowing borrowers to defer repayments for 6 months

- Policies have been introduced to assist tenants who are struggling

Almost half of all households are getting a pay rise

Anyone unemployed over the age of 22 will receive the JobSeeker payment which is the after-tax equivalent of earning $39000 a year. Or if they are on the Job Keeper payment that will also receive the equivalent of $39000 a year.

So, if a couple lost their jobs their household could receive the pre-tax equivalent of $78,000 a year. Or if they were both on Job Keeper they would earn a minimum equivalent of $78000 a year.

That’s before any other benefits or allowances like Family Tax Benefit or rent allowances. Which could add several thousand more to this.

This means that for over half the households in Australia they could in fact be receiving a pay rise.

Home buyers are not the hardest hit

Payroll data from the Australian Taxation Office shows that the brunt of the job losses have been borne by Workers in their teens, 20s and 70s. These are not the primary buying groups in the Australian property market.

Chris Richardson from Access Economics also notes Queensland’s decentralised nature had cushioned the impacts. “People in Queensland don’t live on top of each other in the way they do elsewhere and so a given degree of lockdown loses fewer jobs than it does in other states,”

"Queensland's done a great job (keeping virus numbers down) and you will be a state that bounces back sooner than the Australian average and Australia will bounce back sooner than the world.

Migration

Prior to the shut down Queensland had by far and away the highest net interstate migration of over 22,000 people a year. The next closest is Victoria at 12,198. There’s no reason to suggest this trend won’t continue once restrictions lift which will put a floor under property prices.

Rental protection laws are now balanced

After a complete brain fade the State Government is now introducing laws that are design to protect both the interests of tenants and landlords so that tenants can stay in properties and landlords are not forced to sell due to financial stress.

Vacancy rates

Brisbane’s vacancy rate has been trending downwards for several years. Currently sitting a fraction above 2%. We would expect this to increase to some extent but where’s the extra stock going to come from?

- AirBNB? Most of this accommodation is inner city Brisbane and is mainly 1 -2 bed rooms. A search of AirBNB shows only approx. 300 4 bed properties across the entire of Brisbane. I wouldn’t call an extra 300 properties added to the current 7300 available as being a flood. And let’s face it who holidays in Brisbane anyway?

- Tenants not being able to pay rent due to loss of job or reduced income? Impacted tenants can apply for rental grants and under new provisions where they can provide proof they will have the ability to negotiate with landlords for reduced rent. And as noted above many will have access to either the JobSeeker or JobKeeper payments.

- New construction is at a 6 year low so it’s not coming from there

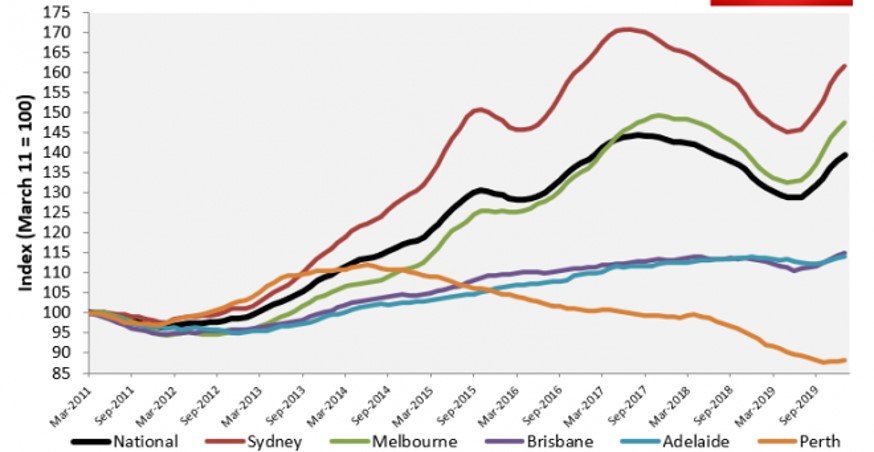

Where will the bigger falls be?

I think the below graph tells the story.

As with any time of uncertainty there is opportunity. The critical factor is having a strategy in place that makes you immune from the daily goings on of the market. Which is why when we work with client’s we focus on the strategy first.

If you would like to discuss how you can position yourself to take advantage of the current market. You can go directly to my calendar to make a time for your free investment review.

I look forward to talking with you

Greg Carroll

How to use investment property to pay off your home loan

MORE THAN ACCOUNTANTS