|

Tuesday, February 04 2014

The TD Securities – Melbourne Institute Monthly Inflation Gauge has risen 0.1% in January, in a significantly more benign result than the 0.7% rise in December. In the 12 months to January the inflation gauge increased by 2.5%, following a 2.7% rise for the 12 months to December. Seasonal adjustments leading to price rises in education, urban transport fares and utilities were offset by falls in the price of clothing and footwear, holiday travel and accommodation as well as books and stationery. Prices for fuel, fruit and vegetables were relatively flat, according to the inflation measure. Head of Asia-Pacific Research at TD Securities Annette Beacher said that the result is particularly noteworthy given January is traditionally a strong one for the gauge, which has risen on average by 0.4% for the month in the last seven years. The results come ahead of the Reserve Bank of Australia’s first board meeting for the year today, with Beacher predicting that the US Federal Reserve’s tapering schedule and recent emerging market concerns are likely to be significant talking points. Saturday, January 25 2014

With rates near record lows there is temptation to lock rates in. But will this actually be the best move and are the savings really there? Before fixing there are a number of things to consider.

Do you eally think you will beat the bank?

3 year fixed rates are sitting around 5.34% and there are variable rates around 4.8%. So straight away you are locking yourself into a higher rate. On a $300,000 loan this would mean $1620 a year more in interest.

And here’s the catch people thinh they are ahaed by fixeing when the variable rate increases beyond the fixed rate. This is incorrect. Your breakeven point is not when variable rates reach 5.34%. The breakeven point is determined by the actual cost of funds over the fixed term. If the loan was interest only your total interest cost over 3 years is $48060. If rates on average remain around 4.8% for the next 12 months and average 5.34% in the second year the rates would have to average above 5.88% for the final 12 months before you cam out ahead.

Remember banks are very good at making profits. They don’t set fixed rates on the basis of losing the bet. They are betting you will end up paying more interest under the fixed rate than if you stayed on variable.

Penalties

Penalties can be into the thousands if you have to exit a fixed rate loan at the wrong time. Remember the timing of exiting a loan may not be of your choosing

Loss of flexibility

Generally there is limited scope to make large lump sum reductions during fixed period - eg you could be on a low rate but can't pay off the loan any faster . Also generally no access to redraw - what if you need those funds for a rainy day?

Also most fixed rate facilities do not offer genuine 100% offset accounts.

You're stuck

What if you require extra funds and the bank says no. You might be forced to refinance and get a nice big penalty on the way out. A realistic proposition in the current market with lenders tightening their policies.

Get advice Saturday, January 25 2014

Resources states Western Australia, Northern Territory and Queensland continue to lead the country. CommSec's quarterly State of the States report shows WA in front on retail spending but lagging on new housing construction. The Northern Territory is now the second strongest economy, backed by strong economic growth, construction work, retail trade, new housing and a substantial reduction in unemployment. Queensland led the way in terms of business investment and came in third strongest on economic growth, retail trade and construction, with a notable improvement in housing finance approvals. Saturday, January 25 2014

Australian houses are still relatively affordable, even though prices have grown faster than those in other major economies, says credit ratings agency Fitch. The Fitch Global and Housing Outlook Report says that in 2014 Australian prices are forecast to outstrip even countries recovering from the GFC. But Australian houses continue to be relatively affordable, thanks to low interest rates and high incomes with only modest employment declines. Fitch says Australian house prices have more than tripled since 1997. Even though prices fell 4% between 2011 and mid-2013, they stayed above those of the UK, our nearest rival. The Sydney Morning Herald reported that house prices compared to per capita GDP are the world's second most favourable. Friday, January 24 2014

People often focus on interest rate when shopping for a loan but there are a range of fees a lender may charge that can make that oh so low rate not so great. Application fees A number of lenders will promote no application fee, but will then charge for valuations and settlement that can end up costing more than $600. IMPORTANT NOTE – I often come across people who get very hung up on paying fees particularly application fees. Certainly you don’t want to pay more than you have to but your priority should be selecting the right loan and structure. Basing your decision on a $600 fee when you are planning to borrow a couple hundred thousand dollars is fairly short-sighted given that making the wrong selection could cost you thousands. Valuation fees Legal/document fees Settlement fees Lenders mortgage insurance (LMI) Service fees Offset fees Switching fees Get advice Friday, January 24 2014

Businesses expect a better trading year in 2014 amid strong profits and a reduction in operating costs. The Commonwealth Bank future business index, which gauges the sentiment of mid-size businesses with a turnover of $10 million to $100 million, suggests businesses are experiencing a sharp increase in confidence. The index was 17 points in the December quarter, its highest level since the survey began in September 2011, and up from 10.8 points in the previous three months. "The vast majority of businesses are anticipating a more prosperous year ahead," said the bank's general manager for corporate financial services, Michael Cant, when the report was released on Thursday. "Notwithstanding the buoyant sentiment .... there remains a level of conservatism as businesses continue to focus on managing costs." The survey found the top three challenges facing business are weak consumer confidence, a falling Australian dollar and uncertainty about government policy decisions. There are also increasing concerns about skills shortages. However, 77 per cent of organisations expect a better performance in 2014 compared with 2013. The survey's revenue index for the next six months jumped to 41 points in the December quarter from 25 in the September quarter, the profit forecasts index increased to 27 from 15, and the operating costs index eased to 29 from 33. Commonwealth Bank chief economist Michael Blythe said the sharp improvement in revenue and profit expectations was quite encouraging. "We're seeing this improved sentiment flow through to other important areas, such as an enhanced appetite for risk and an expected increase in capital expenditure and headcount," he said. Friday, January 24 2014

Two out of three Australian businesses are more optimistic about growth this year compared to 2013. Dun & Bradstreet's Business Expectations Survey shows that 68% of respondents expect positive sales, profits, selling prices, investment and employment. The survey found that 18% of businesses are planning to access new finance during the first quarter, the highest response since the last quarter of 2011.Thirteen percent of businesses plan to increase capital spending, compared to 5% who will decrease spending. Hiring plans have also strengthened, with 15% of businesses intending to take on more staff, taking D&B's employment index to a three-year high of 8.8 points. Thursday, January 23 2014

Monthly home loan approvals reached the highest level in four years in November. The Australian Bureau of Statistics (ABS) says there were more home loan approvals in November 2013 than any other month in the past four years. The resource-rich states of Queensland and Western Australia approved 15% and 12% more home loans respectively than the same time last year. Tuesday, January 21 2014

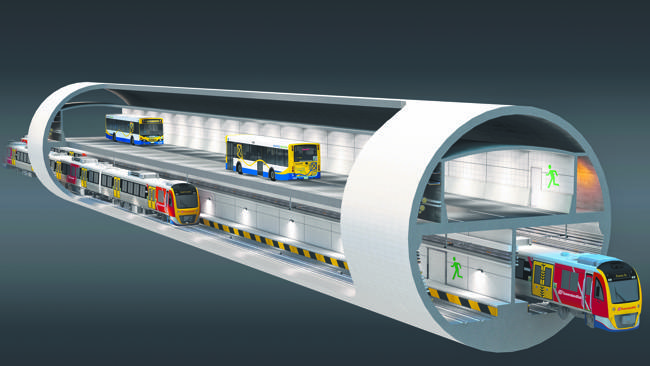

Brisbanites will have access to an innovative double decker public transport tunnel which will accommodate both rail and busway services under the new “UBAT” (underground busway and train) tunnel. The project is budgeted at $5 billion, around $3 billion less than previous Cross River Rail proposal. Premier Campbell Newman announced the Underground Bus and Train project, a 5.4 kilometre tunnel with two train lines in the lower section and two busway lanes in the upper section. “We’ve taken two of Brisbane’s major congestion challenges – the Merivale train bridge and the Cultural Centre bus precinct – and come up with an affordable and elegant solution. “The project we are announcing today delivers the public transport services needed for the next 50 years. “A single 15-metre-wide tunnel will be built, requiring the largest borer ever used in Australia – almost two metres wider than the Clem7 and Airport Link tunnels.” Mr Newman said a public competition would be held early in the New Year to come up with a name for the project. Lobby group Rail Back on Track described the UBAT plan as exciting and welcome news, but spokesperson Robert Dow said it must be constructed with future capacity demands in mind. Tuesday, January 21 2014

Spending is set to lift across the Australian economy this year, after healthy and sustainable growth continued during December, according to new research released today. The Commonwealth Bank Business Sales Index (BSI), which tracks the value of credit and debit card transactions processed by Commonwealth Bank, saw spending rise by a seasonally adjusted 0.4% in December, bringing annual growth for 2013 to 10.6%. Seasonally adjusted data excludes certain seasonal factors to give a more accurate month to month comparison. “The spending increase in 2013 has provided a strong foundation for further increases in 2014,” said CommSec economist, Savanth Sebastian. “The housing recovery continues to gather momentum, while rising wealth levels, low interest rates and a recovering share market is supporting consumer confidence and in turn spending. “The lower Australian dollar should also provide a boost to exports in coming months and help to alleviate the risks surrounding the rebalancing of the economy. “ |