Wednesday, December 03 2014

(SOURCE: Terry Ryder - Property Observer)

There’s a pretty good argument that the hottest property precinct in Australia right now is South East Queensland.

Brisbane, the Gold Coast, the Sunshine Coast: Together they comprise a vast metropolitan area - ongoing urban growth means these three big centres have merged into one big conurbation which starts at the NSW border and extends 250 kilometers north to Noosa.

All three have hot markets. The research conducted by Hotspotting for the latest edition of the Price Predictor Index revealed 254 suburbs across South East Queensland with rising sales activity.

To put that in perspective, the Sydney metropolitan area has 106 growth suburbs. If you add in the Central Coast, which has caught the growth wave from the capital city, there are 120 growth markets.

This shows that, while Sydney is the nation’s hottest big market in terms of price growth, it’s starting to fade (though not markedly, as yet), while South East Queensland is starting to rise.

So when you see headlines suggesting that the boom is fading and price growth is starting to dissipate, remember that it’s Sydney they’re talking about. There are markets elsewhere in Australia that are really just starting their run.

They include Adelaide and Hobart, as well as numerous regional cities in Queensland, New South Wales, Victoria, South Australia and Western Australia.

But the headline event is the rise of South East Queensland. While there has been some price growth in 2014, to date it has been fairly moderate.

The big shift has been in sales volumes and that’s what I mean when I say there are 254 growth suburbs in the region – 254 suburbs throughout Brisbane, the Sunshine Coast and the Gold Coast with distinct patterns of rising sales activity.

The greatest price growth will come in 2015.

I remain hesitant about the Gold Coast. There’s no doubt that the oversupply that has dragged down this market for five years has now been absorbed – and that there is a significant real estate recovery under way.

The heartening thing is that most of the growth suburbs on the Gold Coast at the moment are what I would call genuine housing markets – inland suburbs where houses are being sold, rather than coastal locations where highrise apartments are flogged to investors and speculators.

Unfortunately, that will change. Now that the Gold Coast is back on a growth path, developers are flocking back, intent on creating the next oversupply. Driven more by ego and greed than common sense, developers are competing for the title of biggest project and tallest tower.

And, like their counterparts in Melbourne, it’s all designed for sale to Chinese investors. It won’t end well.

Beyond that cautionary note, the message about Brisbane and South East Queensland looks highly positive at the moment.

The opportunity for investors lies in understanding that the rise in sale volumes we have seen in 2014 is a forerunner to significant price growth.

South East Queensland has more momentum now than does Sydney, but it’s not yet reflected in price growth data.

That is yet to come.

Wednesday, December 03 2014

Deutsche Bank economists have tipped the RBA will cut rates by half a percentage point in 2015.

The cuts would take the cash rate from current historic lows to 2%.

The Deutsche Bank economists previously forecast rates steady until at least mid-2016.

They forecast the first rate cut late in the June 2015 quarter and then again late in the September quarter, or early in the next quarter.

Higher unemployment prompted the Deutsche Bank forecast given they expect unemployment to peak at around 6.75% in 2015, up from 6.2% now, levels that would “ordinarily be consistent with interest rate reductions”.

“What has prevented us, until now, from actually forecasting rate cuts has been the strength in the housing market – in particular house price growth and the degree of investor activity,” the report said.

The recent “nascent signs” of easing in housing market price growth and prospect of regulatory measures to improve the quality of lending should ease the RBA's concerns, they added.

“As always, there are risks to any economist’s view,” they reported.

“In this case the key risks would appear to be a stronger labour market that we expect, or an absence of moderation in parts of the housing market. Obviously, a much weaker AUD could also, in the absence of further declines in the terms of trade, negate the need for rate cuts.”

The DB chief economist Adam Boyton believes the strength in the housing market that has been supporting the economy is easing.

"When we combine that with our expectations for the unemployment rate - which is that it will rise all the way through next year - all that suggests to us that there is scope for the RBA to cut rates further," he told ABC News.

But both the RBA and APRA will want to see more house price data before they are satisfied that house price growth has slowed to a more sustainable pace, Phil O’Donaghoe, at Deutsche Bank, told The Wall Street Journal.

Tuesday, December 02 2014

(SOURCE: First Home Buyer)

The latest Finder Reserve Bank Survey, with 37 experts on the panel, has found that a rise in property prices is largely expected to occur next year.

Money Expert at Finder, Michelle Hutchison, said that this is bad news for first home buyers who are already struggling.

“If you’re a first home buyer struggling to get into the property market this year, next year isn’t looking to get any better,” she said.

Of those surveyed, 69% expect the price gains to continue.

“There were also 14% of respondents who expect property prices to stabilise, while 17% are betting on property prices to fall next year,” she said.

While it isn’t necessarily expected to improve, it may not worsen too much either.

“Most of the experts in the survey are expecting property prices to continue rising however, they don’t expect the higher costs will dramatically impact the first home buyer market,” she said.

The majority, 64%, expect the level of first home buyers active in the market to remain similar to this year, with one in five expecting fewer people will be able to enter market.

“With the national median property price across our capital cities hitting $545,000 in October – 8.9% higher than the previous year – it’s a good time to jump into the property market if you are prepared,” said Hutchison.

“But there’s no point in rushing in you’re not ready, because overstretching your budget could have serious consequences if interest rates rise next year.”

Tuesday, December 02 2014

BIS Shrapnel’s Outlook for Residential Land, 2014 to 2019 report has forecast that Sydney’s upturn will continue but the big performers appear to be Queensland’s Brisbane, Gold Coast and Sunshine Coast. Perth is, however, expecting a downturn over the period.

Sydney’s sales rate in the outer suburbs is notable for being close to its early-2000s level, explains BIS Shrapnel’s senior manager and report author Angie Zigomanis. Despite the increase in sales there has been an extended downturn in Sydney’s land market resulting in a continued shortfall in new housing.

The markets in Brisbane, Gold Coast and the Sunshine Coast can be looked at more as a recovery after extended weakness, with new house and land packages looking affordable relative to established houses with minimal upwards movement for land prices.

Melbourne and Adelaide are forecast to see growth, at a moderate pace, over 2015 – even in the low interest rate environment – with healthy levels of new house building seen in both.

“Demand for land in both the Melbourne and Adelaide markets is showing some increase, underpinned by low interest rates,” said Zigomanis.

“In Melbourne, lot production bottomed out in 2013/14 after the land market was oversupplied due to new subdivisions coming online following the market peaking in 2009/10. As a result, the stock of completed lots had to be progressively sold down before the next round of development could occur,” he said, noting that any excess has now been absorbed by an uptick in land demand, rising prices and low interest rates with sell outs in estates and off the plan sales common.

“Adelaide experienced mild growth in lot production in 2013/14, with low interest rates and limited price growth improving affordability and encouraging greater demand for land. However, the upside is more limited, with slower population growth expected, resulting in milder growth in demand for new dwellings in general. The market is also being impacted by the removal of the Housing Construction Grant at the end of 2013,” he said.

Brisbane – Entered early stages of recovery

Early recovery phase entered in 2013/2014, as lot production rises from 4,700 lots in 2012/2013 to 6,000 lots, though it remains below 8,900 lots per annum produced in the 10 years to 2011/2012.

“The improvement in lot production in 2013/14 was underpinned by the emergence of pent up demand for new houses after the sustained period of low new dwelling activity following the GFC,” said Zigomanis.

“Cuts to interest rates have improved the affordability equation for Brisbane home buyers, while weak land prices over the last five years have also made new housing more attractive.”

Key driver: Net interstate migration expected to pick up with strong price growth in southern states to encourage some to look to Queensland. Deficiency of dwellings to remain.

Lot production forecast to continue to rise and peak at 9,000 lots per annum by 2015/2016. Lot sizes have failed to maintain affordability, but are larger on average than other capitals.

Tuesday, December 02 2014

(SOURCE: CBA)

The average house in Australia is now worth over $75,000 more than at the same time two years ago, with a house in New South Wales (NSW) almost $100,000 more expensive than in any other part of the country.

New figures released today by the Australian Bureau of Statistics (ABS) showed the average house price in Australia during the September quarter was $563,100, up $76,700 on the median price of $486,400 recorded during the same period in 2012.

The data, which measured the price change in residential dwellings across the states, saw residential property prices up by 9.1% compared to a year ago, with NSW driving up the median price with the most expensive real estate in the country.

The average house price in NSW is now $681,900, compared to the lowest average house price of $312,000, which was found in Tasmania.

Over the September quarter the average price of a residential house increased across all the states except for Western Australia, where the price dropped slightly to $588,700.

Tuesday, December 02 2014

(SOURCE: First home buyer)

If you’re living with your parents, finding it tough to enter the property market, then you’re certainly not alone.

With property prices increasing, it’s becoming more common for multiple generations to live together in one home, according to QM Properties’ sales manager Damien Ross.

While many have heard of the granny flat, for keeping elderly relatives at the family home with their own privacy, it’s not quite as common to build a property from the ground up with a multi-generational family in mind.

“Young people are staying at home longer and often couples are living with their parents so they can save for their first home,” explains Ross.

The idea of living at home to save a larger deposit is compelling for many first timers and it’s likely that this will increasingly be the case should property prices continue to rise.

This trend is now so established that builders are creating homes designed specifically for multi-generational living, splitting properties into two separate homes with one common fire wall. They even suggest that the outside living areas could be divided with a wall, hedge or fence. With two kitchens, three or four bedrooms, three bathrooms and separate entries, it’s close to, but not quite, a duplex.

The home is not a duplex, it is still within Residential A zoning so there are no related council fees that come with duplex sites.

It’s expected that this type of home will become more common in areas with median prices out of reach for many buyers.

Thursday, November 06 2014

The most recent Real Estate Institute of Queensland (REIQ) statistics show that rental markets remain tight, with south-east Queensland’s Logan and Ipswich becoming strong rental hotspots for investors.

REIQ CEO, Antonia Mercorella, said that the latest Residential Rental Survey, conducted at the end of September, found that just four of Queensland’s 16 major regions recorded significant changes in vacancy rates.

She noted that this is evidence of a two-tier residential rental market across the state.

“Logan and Ipswich are emerging as the south-east’s rental hotspots as tenants move further afield from inner-Brisbane in search of more affordable rents,” Mercorella said.

“For the rent you’d pay for a three-bedroom house in Brisbane, you can get a four bedroom house in Brisbane’s outlying areas for up to $65 less a week.”

She noted that, for this reason, Logan and Ipswich are now very tight rental markets with the lowest vacancy rates in the Greater Brisbane region.

By the close of September, Brisbane City LGA recorded a 2.3% vacancy rate, relatively stable since the end of June.

“Brisbane’s middle to outer suburbs – those 5-to-20 kilometres from the CBD - recorded a slight easing in vacancy levels, up 0.2% to 2% at the end of September,” she said.

“The city’s inner suburbs, on the other hand, recorded a vacancy level of 2.9%, down from 3.4% at the end of June.”

The Residential Tenancy Authority’s records of median weekly rents for the September quarter also noted relatively steady rents across the LGA, with greater Brisbane returning to a vacancy rate seen 12 months ago – 1.7%.

“Vacancy levels in the Moreton Bay and Redland City council areas remained relatively steady over the three months to September, with both recording 1.8%,” she said.

“While not quite as tight as Logan and Ipswich, strong investor activity and tenant demand are setting the scene for competitive rental markets in both LGAs.”

Logan City’s vacancy rate currently sits at 1.5%, with Ipswich City at 1.6%, both down 1.4%.

SOURCE: Property Observer

Thursday, November 06 2014

Paying off debt is a good goal to have. But doing it to the exclusion of an investment plan will most likely see you well short of where you want to be in retirement.

It takes significant time to build substantial wealth, 20 - 30 years. So focusing just on clearing debt and hoping you can somehow pull it together in the last 5-10 years of your working life is going to see you come up well short.

But according to a new survey by REST Industry Super Australians are doing just that.

Only 15% of 35 to 49 year olds are prioritising long-term savings, while property debt is the dominant priority for this age group.REST Industry Super’s latest whitepaper, What’s Next, surveyed 1,000 Australians aged between 35 to 49 year on the state of their financial health.

Of the respondents, 71% are paying off a mortgage, which is their main financial aim. Long-term savings are the fourth highest priority, after paying off debt and short-term savings. Short-term savings, including holidays and education costs, was the top priority for those without mortgages.

REST CEO Damian Hill said that it’s encouraging to see this group take control of their immediate finances, including getting their mortgage under control. However, he said that it seems to be to the detriment of planning for the future.

“We know that relying solely on employer super contributions is unlikely to support the kind of lifestyle most Australians want in retirement, so it’s important to prioritise saving for post-work life as well,” Hill said.

“This is even more the case since the recent government announcement to delay the increase in the superannuation guarantee contribution rate to 12% until 2025.”

The 8% of respondents who owned their home outright prioritised retirement as their most important goal.

“Focusing on paying off the house means that over half (51%) of Australians are relying solely on the compulsory super system to save for their retirement – at the very stage of life when they are likely to be in the best position to make additional contributions on top of what their employer is paying,” Hill said.

“Planning for retirement doesn’t mean your mortgage has to suffer, but it is important to balance your financial priorities to ensure long-term savings aren’t being forgotten in the face of more immediate needs.”

However, some 6% of the respondents were saving for property in different ways. Of this small portion, some were using property investments, including their home, as a retirement plan.

Thursday, September 25 2014

Thursday, March 27 2014

As I discussed previously the biggest area of lending growth is investors. (refer graph below)

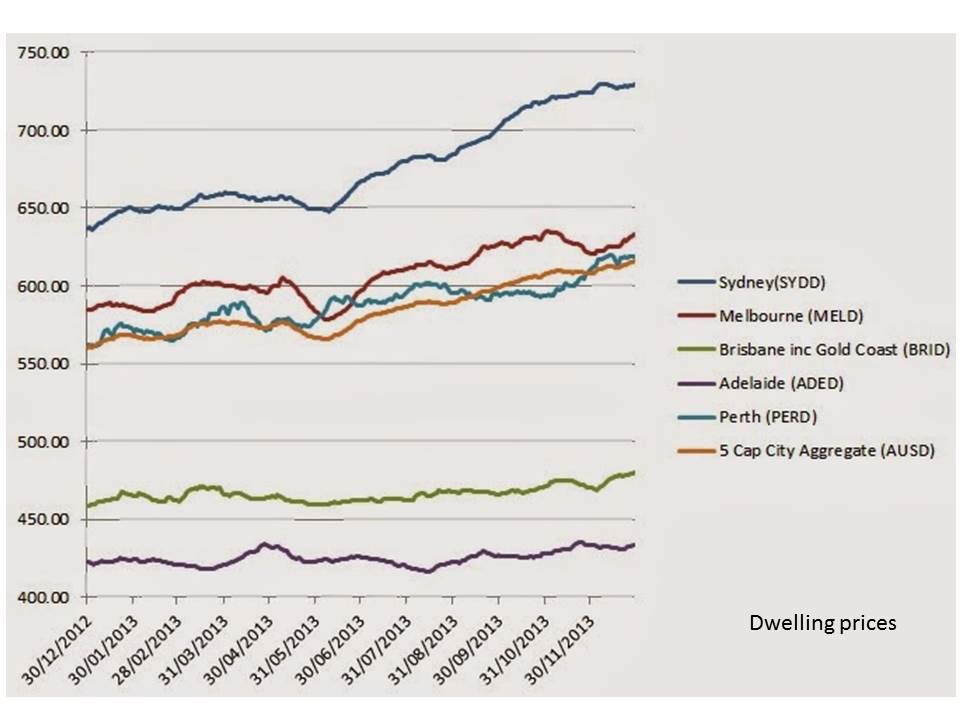

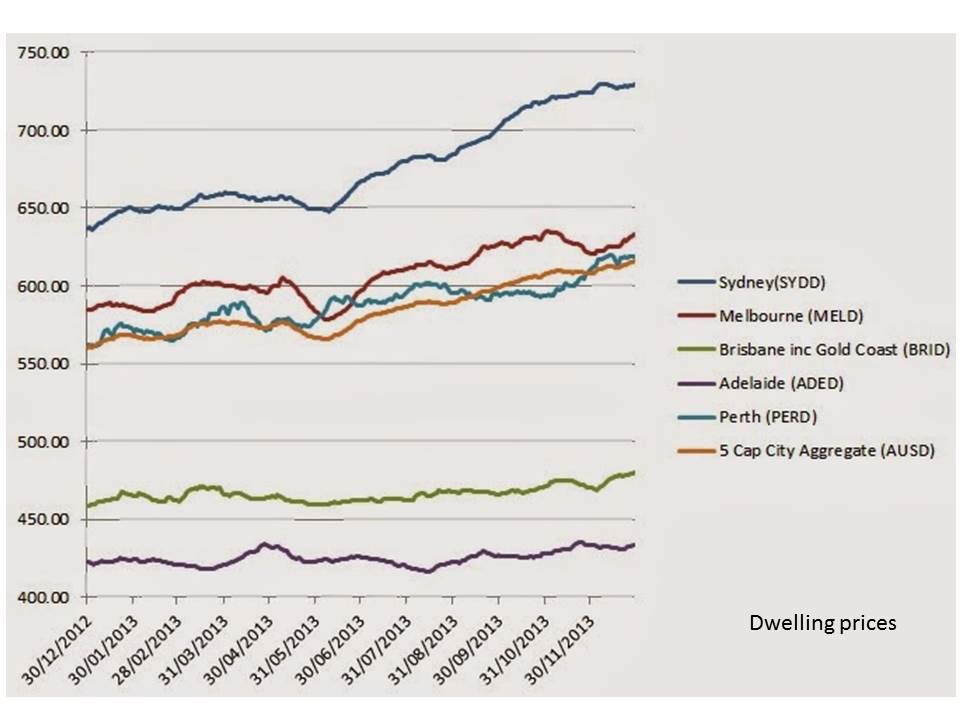

But which locations are likely to be in investors sights in 2014? We believe the below chart provides a bit of a clue.

Brisbane certainly presents an affordable option to investors when contrasted against the other major capitals and still appears in early stages of receovery.

The question is how can you take advantage? Where area the areas an opportunities that are likely to present good long term growth and deliver solid cashflow that will enable you to hold the property over the long term. Particularly if rates rise.

There's is no doubt many people will jump in head first but many will get it wrong.

Contact us to discuss how you can take advantage.

|