Queensland is tipped to replace New South Wales as the most optimistic state regarding the residential property market and lead the country for price and rental growth over the next two years, according to the NAB Residential Property Survey.

The NAB Residential Property Survey found market sentiment improved notably in Queensland and was less negative in SA/NT, softened in Victoria and NSW and fell to a new low in WA.

NAB Group chief economist Alan Oster said the NAB Residential Property Index fell -7 to +10 points in the September quarter - its second consecutive fall - with the index now below its long-term average (+14 points), however it’s not all negative as the overall picture masks some big differences across individual state markets.

“The survey also suggests that yield compression will continue as capital growth outpaces rental growth in all states,” he said.

“Foreign buyers were notably more active in Victoria, where they accounted for just over 1 in 4 of all new property sales and around 1 in 7 sales of established homes.

"In established property markets, foreign buyers accounted for around 11.3% of all apartment sales and 9.5% of house sales. These ratios were significantly higher in Victoria, where foreign buyers accounted for around 1 in 5 of all established apartment sales and just over 1 in 6 houses.

The report noted expectations for national house price growth over the next 1-2 years were scaled back to 1.5% and 1.8%.

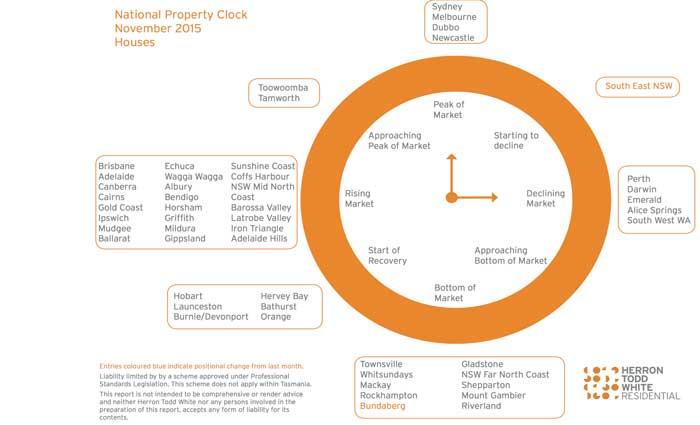

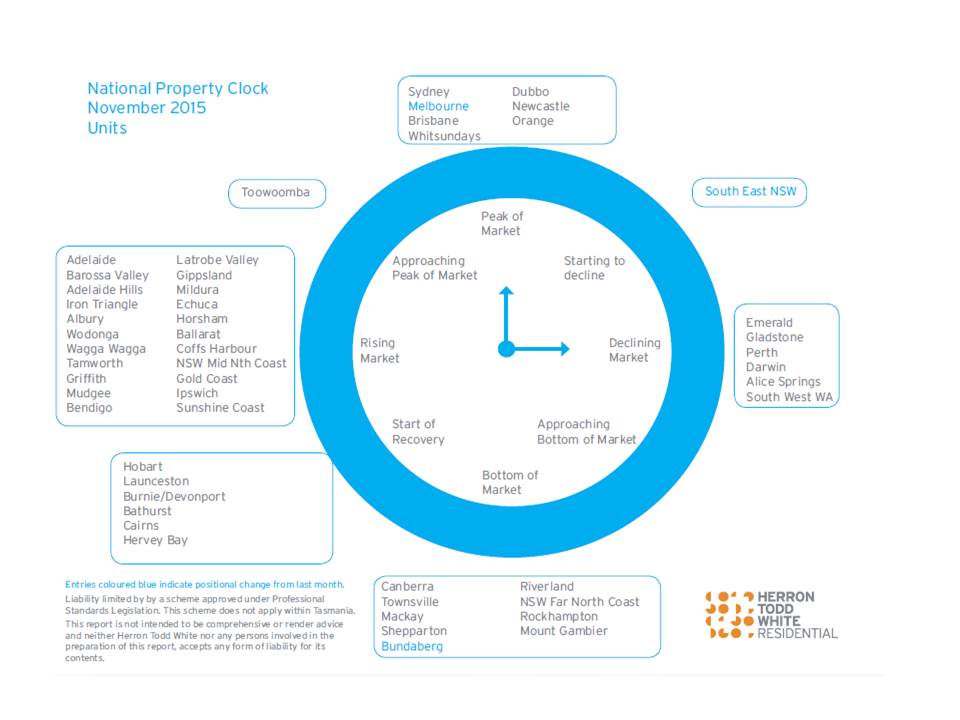

"However, this also masked a notable improvement in Queensland, which is now predicted to be the leading state for capital growth in the next few years (2.6% & 3.4%). In contrast, expectations were cut back in NSW (2.2% & 1.8%) and Victoria (1.9% & 1.9%), and remain weak in SA/NT (-0.2% & 0.5%) and WA (-0.7% & 0.4%)," it read.

"In 2016, the slowdown in average national house price growth to 2.3% is largely driven by a moderation in both Sydney and Melbourne prices growth. NAB Economics expects house price growth to decelerate in Sydney to 1.2%, while price growth in Melbourne will ease to 3%. Brisbane is tipped to see the fastest house price growth (4.5%), and the Adelaide market is expected to improve (2.4%). Perth will remain weak, although price declines are forecast to ease."