|

Monday, February 19 2018

There is a saying in law that a person who chooses to represent themselves has a fool for a client. The same could be said for a landlord who self-manages their investment property. I’m sure there are some people who do it effectively but from my experience it is a false economy. In trying to save a few dollars in management fees a landlord could be giving up much more resulting in an under-performing property. There are many reasons why an experienced property manager will achieve a better result for your property than you can Performance Keeping it business not personal The other classic self-management example is renting to friends or family – a major mistake. What are you going to do when they don’t pay rent, damage the property or its time to increase the rent and they cry poor. A good manager will get you rent increases when the market permits and still keep a tenant on long term. Market knowledge Screening tenants Legal requirements Repairs and maintenance Tax deductible Time If your property was rented for $400 and your manager charged 8.5% plus GST then you would be paying $37.40 a week. If you had to spend 3 hours a week on average managing your property that's $12.46 an hour. Surely your time is worth more than that? It’s possible to achieve good returns and cashflow with investment property without trying to self-manage. Book in for a FREE telephone appointment with me and we can discuss how you could achieve this. Book your FREE appointment now. I look forward to talking with you Friday, February 16 2018

Wednesday, February 14 2018

In addition to saving a deposit or using equity in an existing home you also need to allow for a range of costs when purchasing a property. When added up these costs can range between 4% to 7% of the purchase price. Saturday, February 10 2018

This week’s market volatility provides a good opportunity to reflect on investment attitudes that apply across any investment class including property. Wednesday, February 07 2018

Brisbane is well placed to take over as the best performing capital city housing market over the next five years. Wednesday, February 07 2018

The deposit requirements to purchase a property are a common point of confusion for first home buyers. Which is understandable as a lot of information out there is unclear or just plain incorrect. Monday, February 05 2018

Friday, February 02 2018

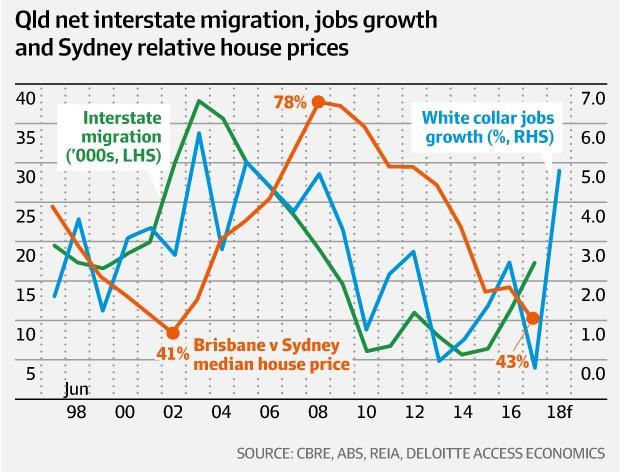

Queensland is in a historical sweet spot for home price growth with an analysis of interstate migration showing that the gap in home price between Sydney and Brisbane could soon start narrowing. In 2002, the median Brisbane home price equated to just 41 per cent of a Sydney home – a historical low. But interstate migration to Queensland started to surge, peaking in 2003 at about 40,000. Home prices started to rise as the interstate migration rose and the gap between median Sydney and Brisbane prices started to narrow. Brisbane home prices were able to reach as much as 78 per cent of a Sydney home price in 2008. CBRE researcher Ally McDade has analysed the numbers and highlights that the same process is starting to happen again. "At June 2017, levels of interstate immigration reached the highest quarterly and annual growth since 2008," she said, "Over the year to June 2017, interstate migration to Queensland increased by an impressive 50 per cent, or circa 17,500 persons." "As more people migrate to the Sunshine State, the equity wealth built in Sydney is transferred to Brisbane," Ms McDade said. "This increase in demand, coupled with a higher perceived value, has historically driven Brisbane real estate prices higher." Large and small developers in Queensland are noticing the interstate change. Stockland analysis shows that most interstate buyers to Queensland are coming from NSW, representing about two thirds of total interstate purchases in Stockland's south-east Queensland communities. Victorian buyers accounted for a further 12 per cent of interstate purchases, followed by South Australia (8 per cent) and the ACT (6 per cent). Friday, February 02 2018

Thursday, February 01 2018

The Consumer Price Index (CPI) rose 0.6 per cent in the December quarter 2017. Certainly no early RBA hike here! was Shane Oliver's immediate tweet. The CPI rose 1.9 per cent through the year to December quarter 2017 having increased 1.8 per cent through the year to September quarter 2017. Still beow the RBA's target band. |