|

Tuesday, February 04 2014

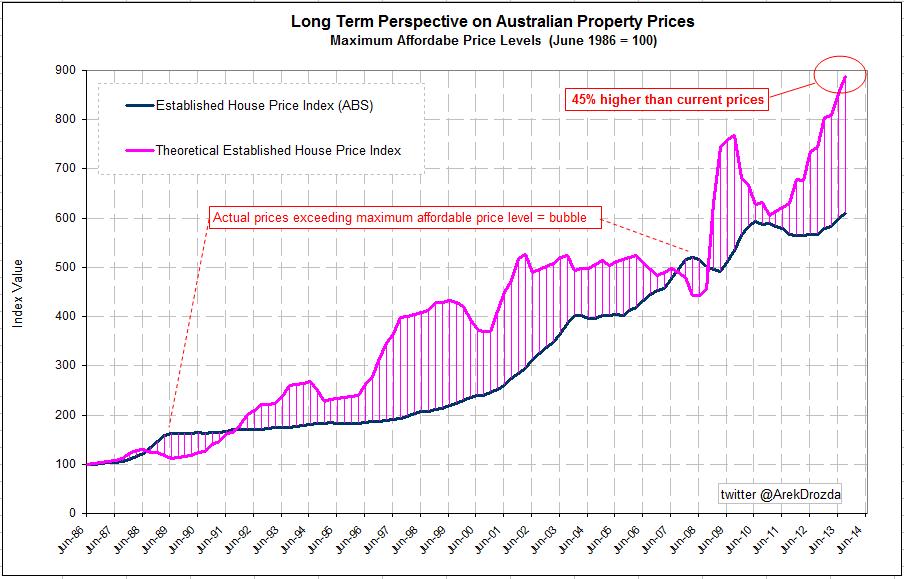

In interesting article I came across last week below. Australian property prices in 2014 and beyond - a peek into the future By Arek Drozda In my previous article, 'Australian property prices explained', I presented a chart that provided very accurate narrative on what has happened in the Australian property market over the last three decades. It is safe to conclude that the same concept which allowed for the description of the past with such accuracy, should also be able to provide a reasonable guidance for the future. Of course, predicting exactly what will happen in 2014 and beyond is a tall order. Life is known to create such a variety of unanticipated scenarios that the reality will almost certainly play out differently to what everybody expects. Therefore, I prefer to think about the future in terms of a range of possible outcomes and likely probabilities of occurrence rather than as a single, definite result. The real benefit of such an approach is knowing how changes in economic conditions can potentially affect the outcome - not in picking the exact end result in advance. Since changes in some economic factors will have more profound effects than others, if you can identify in advance what are they, you can watch out for the tell-tale signs that a particular scenario is playing out – and act accordingly. You only need to be right about the direction property prices are heading to be able to benefit. Please consider what follows with caution - in the “what if” category, rather than a certainty. Based on the income capacity of working Australians, residential property in this country is not overpriced and prices are far from bubble territory. The proof is in relative changes in the cost of buying over the last 27 years, which has been significantly below the relative changes in personal incomes over that time. Below is a slightly different representation of that information to highlight this point.

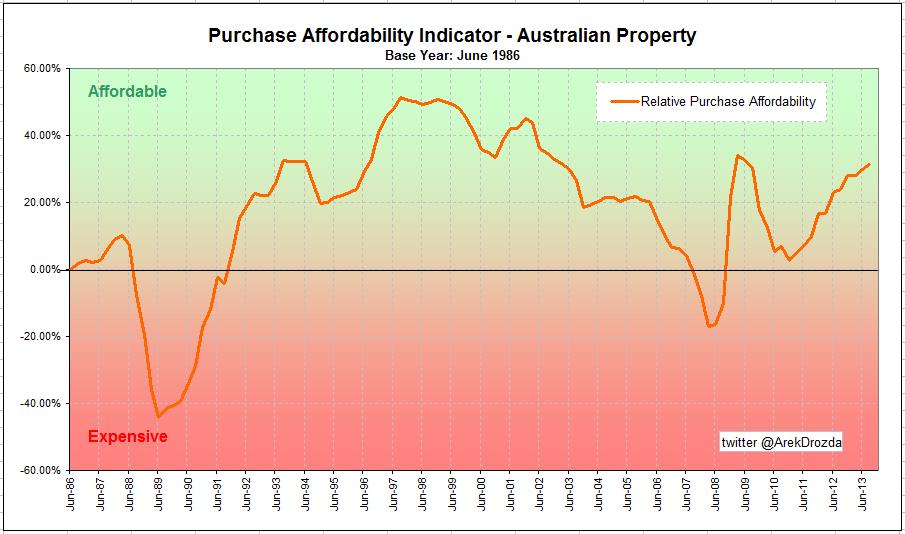

By rearranging the data we can create a chart that shows how much more property prices could increase at present and still be considered affordable (in relation to current incomes and as benchmarked to 1986).

The above chart indicates that current property prices are potentially undervalued by as much as 45%. Of course, this does not mean that prices will immediately move by this much but the potential for a substantial jump is there. Yet another perspective using the same underlying data reveals that conditions are now starting to resemble those in 2009. Although affordability in 2009 was not as extreme as in late 1990’s, it nevertheless led to a substantial price increase in 2010.

Therefore, as history shows, if interest rates remain mostly unchanged and incomes keep growing, we can anticipate a significant jump in property prices in coming years. The increase could either be a rapid advancement of 10-20%, or even 30%, in the next 12-24 months if the 'good times' perspective prevails or, if pessimism dominates, it could result in an even more substantial jump but in the more distant future. Of course, this scenario can only play out on the proviso that there are no unexpected shocks applied to the system, such as a major international conflict, another economic calamity in the region, another collapse of world financial system, or a major natural disaster – to mention a few obvious cases. In terms of further outlook, if the relationship between costs of buying, incomes, rents and prices hold in the future, and the current rate of income growth continues, then it can be estimated that from now to the end of 2023 property prices could grow by as much as 140% under a historically low interest rate scenario (i.e. 5% per annum), or as little as 20% under a high interest rate scenario (i.e. 10% per annum). Under a more probable scenario of slower growth in incomes and interest rates averaging 7% per annum over the next decade, prices can still be expected to grow by 60% in the next 10 years. A much gloomier future is also possible but the probability of this scenario is rather small at this point in time. That is, a 40% drop in property prices is possible in the next decade but it would take extreme economic conditions for this scenario to play out. In particular, mortgage rates would have to persist at close to 20% per annum for a good part of the decade and income growth would have to drop to 2% per annum to bring prices down by this much. In conclusion, the outlook for property prices in Australia is positive - unless of course the world encounters another economic disaster of a magnitude that is hard to even imagine. Some insist that the next big event is 'just around the corner' so, it would be wise to keep an eye for the tell-tale signs of possible troubles brewing somewhere in the world but there is no obvious reason to panic just yet. Arek Drozda is an independent analyst who has worked in the public and private sectors for over 20 years in business development, data analysis and in building geographic information systems. |