|

Thursday, February 13 2014

ONE of the country’s biggest banks expects house prices to rise as much as 20 per cent before the end of next year, with lifts predicted to begin soon in parts of Queensland. ANZ chief economist Warren Hogan told the Committee of Economic Development of Australia that the “housing market is at the early stages of a solid cyclical upswing” fed by low interest rates and market shortfalls. “We expect a 15-20 per cent lift in home prices between 2013 and 2015,” he said with long-awaited rises already underway in Sydney and Melbourne. “I am sure Brisbane, Sunshine Coast and Gold Coast will lift in terms of house prices in the next little while,” he said in the Sunshine State yesterday. Mr Hogan said investors and “new participants” in the market — such Chinese and other overseas buyers who typically did not need to borrow in Australia - were pushing increases. “They’re quite active and their judgment on what is fair value for property is very different from others in the market,” he said. “I think that’s something to keep an eye on.” But experts agreed Australia was not in a house price bubble yet. Commonwealth Bank head Ian Narev said: “We never say never — but we don’t think we are seeing even the early signs of a bubble at the moment.’’ Queensland Treasurer Tim Nicholls said there was no evidence of a housing bubble in the state. “In Queensland we’re seeing steady but moderate growth in house prices, so we’re not overly concerned about a bubble here,” he said. “We think that Queensland growth rate is about right. We’d like to see some more growth coming through in terms of the number of houses and approvals coming through, but in terms of prices, we’re not seeing a bubble coming through here.” Mr Hogan agreed it was not a bubble “but it could be”. “If you whack the big four banks together, the system is only growing at five per cent, even though we’re writing new mortgages at 18 per cent ... Overall credit growth is still quite tepid so you wouldn’t say that that’s a bubble.” Wednesday, February 12 2014

Asbestos materials of various types were commonly used in Australian property construction between 1940 and 1990. Asbestos materials were embedded in wall cladding, roofs, gutters, drain pipes, vinyl flooring, electrical wiring thermal insulation, boilers, exhaust pipes, switchboards, thermal insulation and inside fire doors. The new National Work Health and Safety Act of 2011 requires owners of buildings constructed before 2003 to conduct an asbestos survey. Where asbestos materials are identified, this triggers the mandatory requirement for an asbestos register and asbestos management plan (AMP). Some property owners appear to be unaware of this new obligation. An asbestos register is necessary to track of asbestos materials remaining (or removed) in investment properties. Asbestos may also be located in inaccessible areas and unfortunately discovered during re-development with sometimes disastrous and costly results. Asbestos materials if disturbed can cross contaminate internal areas of the buildings, requiring evacuation, loss of rent and potential occupant litigation. Asbestos removal is a legally notifiable project, which can result in extremely costly asbestos removal projects. Careful investigation during due diligence can forewarn investors, revealing the true cost of asbestos removal. Armed with detailed information and cost options, investors can then more accurately evaluate if they wish to proceed with the purchase or avoid the risk. Wednesday, February 12 2014

Australia’s economic growth is expected to pick up pace this year thanks to a lower exchange rate and stronger activity in the housing and retail sectors, according to the latest forecasts from the Reserve Bank of Australia. Investment in the mining and resources sector is forecast to peak some time this year and a pick up in the non-mining sectors of the economy is needed to maintain economic growth. “Until recently, survey measure of current business conditions have been below average, consistent with subdued non-mining investment,” the RBA said in its quarterly statement on monetary policy. “A number of indicators, however suggest a gradual increase in growth over time.” “The depreciation of the exchange rate should provide some additional impetus to activity in the traded sectors of the economy,” the RBA said. The bank said that business conditions improved in the latter part of 2013. “Retail sales and the Bank’s liaison point to a pick up in household consumption growth in the December quarter and measures of consumer sentiment remain a little above average levels,” the RBA said on Friday. Wednesday, February 12 2014

While Sydney and Melbourne’s property markets may struggle to sustain their phenomenal recent growth rates, Brisbane is being tipped to benefit from its ample room for capital growth and rental yield potential. Brisbane’s property market is showing signs of growth early this year, which is good news for buyers seeking a relatively affordable investment. RP Data’s research director Tim Lawless suggested this week that while the “investment fundamentals” are waning in markets such as Sydney and Melbourne, investors might turn to Brisbane because it’s much earlier in the growth cycle. The stage that a property market is at in the growth cycle is influenced by the level of supply and demand. In Brisbane’s case, increasing demand could certainly see values climb above the current median of $462,000. Throw in the city’s solid rental yields, which are hovering round the 5% mark and notably higher than averages in both Sydney and Melbourne, and there’s plenty of reasons for optimism. Monday, February 10 2014

The housing market is in the early stages of a solid cyclical upswing, buoyed by low interest rates, but it's not a bubble, ANZ Bank chief economist Warren Hogan says in a Committee for Economic Development of Australia report. "Our view is that prices remain largely explained by low interest rates, sharply improved affordability, the release of pent-up sales demand created over recent years and an unprecedented (and increasing) shortage of physical housing stock," Hogan writes. He says the majority of future price gains will be in Sydney, Perth and Melbourne, with investors driving the upturn in the market. Friday, February 07 2014

Leading agent John McGrath has forecasted that the strongest east coast market over the next three years was likely to be south-east Queensland. "The market I am really excited about is south-east Queensland." "Prices in Brisbane and the Gold Coast are still below pre-GFC levels, while Sydney is about 10% above now, so there is a greater likelihood of better capital growth in the sunshine state over the next few years." Currently, the median house price in Brisbane is $470,000 whereas Sydney is $775,000. Brisbane’s median apartment price is $383,000 compared to $557,000 in Sydney. RP Data also provides joint Brisbane-Gold Coast data showing a 4.9% growth in house prices and 2% in apartments. McGrath says a "phenomenal spring season" in Sydney last year, I was expecting another good year for Sydney," but the strongest market over the next three years is likely to be south-east Queensland. "In short, we ain’t seen nothing yet! We’re just at the beginning of the recovery." McGrath suggests of south-east Queensland. Friday, February 07 2014

If you have a capital loss it is carried forward until you make a capital gain. Other losses are treated differently. For example if your business or rental property loss pushes your current year income below zero, you are entitled to carry that loss forward into the next financial year, but first you must reduce it by any exempt income you have received, for example Centrelink family payments. Further, you cannot pick and choose when you offset the loss. It must be used up immediately. This can mean it is wasted. For example if you have a $10,000 carried forward loss but only have $15,000 in taxable income in the following year then the loss from the previous year must be used to reduce your taxable income down to $5,000. The loss is wasted because you would not have had to pay tax on the $15,000 anyway. Tuesday, February 04 2014

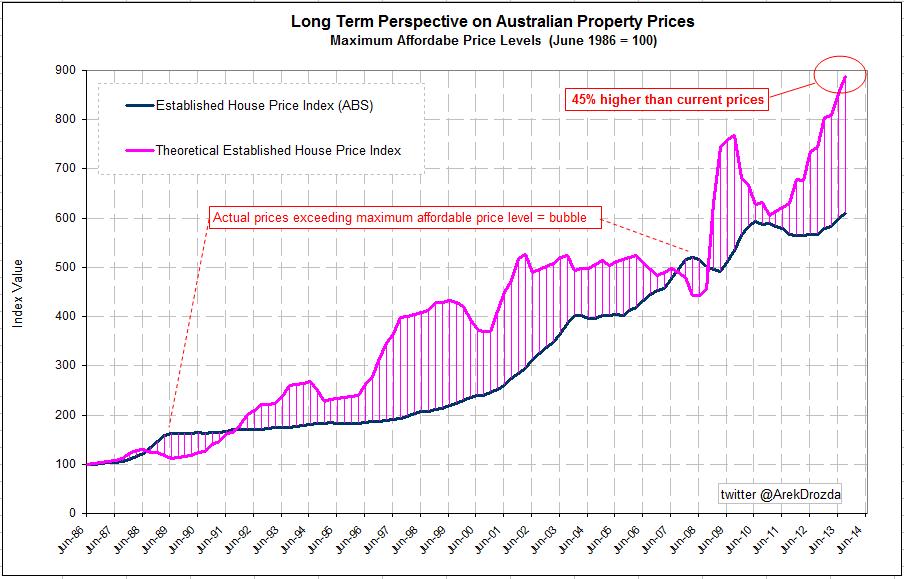

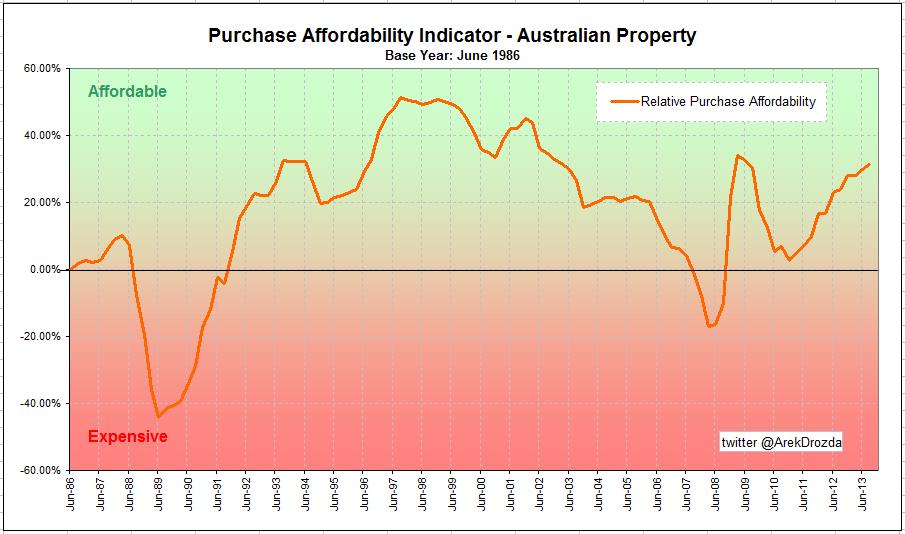

In interesting article I came across last week below. Australian property prices in 2014 and beyond - a peek into the future By Arek Drozda In my previous article, 'Australian property prices explained', I presented a chart that provided very accurate narrative on what has happened in the Australian property market over the last three decades. It is safe to conclude that the same concept which allowed for the description of the past with such accuracy, should also be able to provide a reasonable guidance for the future. Of course, predicting exactly what will happen in 2014 and beyond is a tall order. Life is known to create such a variety of unanticipated scenarios that the reality will almost certainly play out differently to what everybody expects. Therefore, I prefer to think about the future in terms of a range of possible outcomes and likely probabilities of occurrence rather than as a single, definite result. The real benefit of such an approach is knowing how changes in economic conditions can potentially affect the outcome - not in picking the exact end result in advance. Since changes in some economic factors will have more profound effects than others, if you can identify in advance what are they, you can watch out for the tell-tale signs that a particular scenario is playing out – and act accordingly. You only need to be right about the direction property prices are heading to be able to benefit. Please consider what follows with caution - in the “what if” category, rather than a certainty. Based on the income capacity of working Australians, residential property in this country is not overpriced and prices are far from bubble territory. The proof is in relative changes in the cost of buying over the last 27 years, which has been significantly below the relative changes in personal incomes over that time. Below is a slightly different representation of that information to highlight this point.

By rearranging the data we can create a chart that shows how much more property prices could increase at present and still be considered affordable (in relation to current incomes and as benchmarked to 1986).

The above chart indicates that current property prices are potentially undervalued by as much as 45%. Of course, this does not mean that prices will immediately move by this much but the potential for a substantial jump is there. Yet another perspective using the same underlying data reveals that conditions are now starting to resemble those in 2009. Although affordability in 2009 was not as extreme as in late 1990’s, it nevertheless led to a substantial price increase in 2010.

Therefore, as history shows, if interest rates remain mostly unchanged and incomes keep growing, we can anticipate a significant jump in property prices in coming years. The increase could either be a rapid advancement of 10-20%, or even 30%, in the next 12-24 months if the 'good times' perspective prevails or, if pessimism dominates, it could result in an even more substantial jump but in the more distant future. Of course, this scenario can only play out on the proviso that there are no unexpected shocks applied to the system, such as a major international conflict, another economic calamity in the region, another collapse of world financial system, or a major natural disaster – to mention a few obvious cases. In terms of further outlook, if the relationship between costs of buying, incomes, rents and prices hold in the future, and the current rate of income growth continues, then it can be estimated that from now to the end of 2023 property prices could grow by as much as 140% under a historically low interest rate scenario (i.e. 5% per annum), or as little as 20% under a high interest rate scenario (i.e. 10% per annum). Under a more probable scenario of slower growth in incomes and interest rates averaging 7% per annum over the next decade, prices can still be expected to grow by 60% in the next 10 years. A much gloomier future is also possible but the probability of this scenario is rather small at this point in time. That is, a 40% drop in property prices is possible in the next decade but it would take extreme economic conditions for this scenario to play out. In particular, mortgage rates would have to persist at close to 20% per annum for a good part of the decade and income growth would have to drop to 2% per annum to bring prices down by this much. In conclusion, the outlook for property prices in Australia is positive - unless of course the world encounters another economic disaster of a magnitude that is hard to even imagine. Some insist that the next big event is 'just around the corner' so, it would be wise to keep an eye for the tell-tale signs of possible troubles brewing somewhere in the world but there is no obvious reason to panic just yet. Arek Drozda is an independent analyst who has worked in the public and private sectors for over 20 years in business development, data analysis and in building geographic information systems. Tuesday, February 04 2014

The TD Securities – Melbourne Institute Monthly Inflation Gauge has risen 0.1% in January, in a significantly more benign result than the 0.7% rise in December. In the 12 months to January the inflation gauge increased by 2.5%, following a 2.7% rise for the 12 months to December. Seasonal adjustments leading to price rises in education, urban transport fares and utilities were offset by falls in the price of clothing and footwear, holiday travel and accommodation as well as books and stationery. Prices for fuel, fruit and vegetables were relatively flat, according to the inflation measure. Head of Asia-Pacific Research at TD Securities Annette Beacher said that the result is particularly noteworthy given January is traditionally a strong one for the gauge, which has risen on average by 0.4% for the month in the last seven years. The results come ahead of the Reserve Bank of Australia’s first board meeting for the year today, with Beacher predicting that the US Federal Reserve’s tapering schedule and recent emerging market concerns are likely to be significant talking points. Saturday, January 25 2014

With rates near record lows there is temptation to lock rates in. But will this actually be the best move and are the savings really there? Before fixing there are a number of things to consider.

Do you eally think you will beat the bank?

3 year fixed rates are sitting around 5.34% and there are variable rates around 4.8%. So straight away you are locking yourself into a higher rate. On a $300,000 loan this would mean $1620 a year more in interest.

And here’s the catch people thinh they are ahaed by fixeing when the variable rate increases beyond the fixed rate. This is incorrect. Your breakeven point is not when variable rates reach 5.34%. The breakeven point is determined by the actual cost of funds over the fixed term. If the loan was interest only your total interest cost over 3 years is $48060. If rates on average remain around 4.8% for the next 12 months and average 5.34% in the second year the rates would have to average above 5.88% for the final 12 months before you cam out ahead.

Remember banks are very good at making profits. They don’t set fixed rates on the basis of losing the bet. They are betting you will end up paying more interest under the fixed rate than if you stayed on variable.

Penalties

Penalties can be into the thousands if you have to exit a fixed rate loan at the wrong time. Remember the timing of exiting a loan may not be of your choosing

Loss of flexibility

Generally there is limited scope to make large lump sum reductions during fixed period - eg you could be on a low rate but can't pay off the loan any faster . Also generally no access to redraw - what if you need those funds for a rainy day?

Also most fixed rate facilities do not offer genuine 100% offset accounts.

You're stuck

What if you require extra funds and the bank says no. You might be forced to refinance and get a nice big penalty on the way out. A realistic proposition in the current market with lenders tightening their policies.

Get advice |