|

Monday, July 01 2024

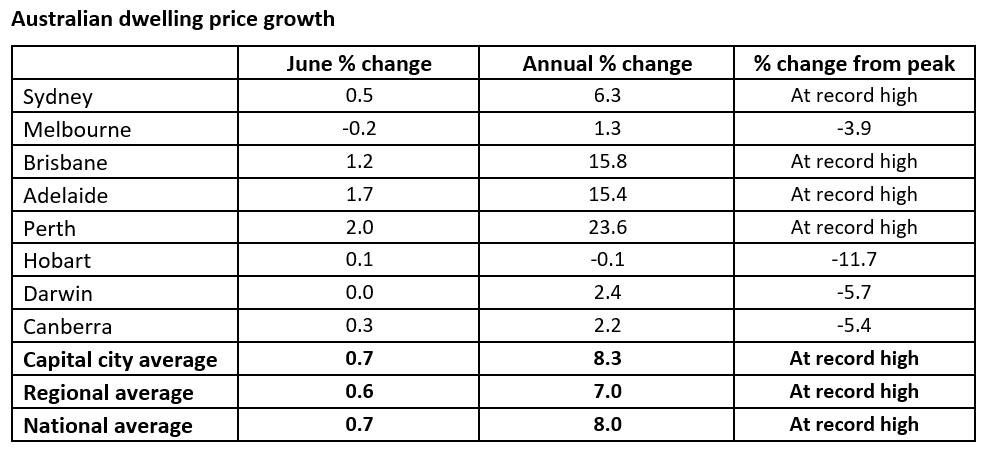

The monthly house price results from CoreLogic show national house prices rose another 0.7% in June, taking the annual growth to 8%. Perth (+2%), Adelaide (+1.7%) and Brisbane (+1.2%) had the strongest growth over the month, with Perth now up more than 23% over the year. Melbourne (-0.2%) was the only capital city to see house price soften.

Sunday, June 30 2024

Regional house prices are expected to hit record highs in almost all parts of Australia in the next 12 months, according to analysis by Domain. Sunday, June 30 2024

Growing demand for apartments means unit values are tipped to hit record highs in more suburbs in the coming months. Thursday, February 22 2024

It is possible to borrow up to 95% for investment purchases. Typically the maximum most lenders will go to for investment is 90% but some will lend up to 95%. Meaning a substantially lower deposit. This means you can push your purchasing range further or keep more capital up your sleave for your next investment purchase. This is available for both purchases and construction. Wednesday, January 17 2024

Dual income property in Brisbane South - 6.55% Yield Wednesday, January 17 2024

What is the loyalty tax?

Significant potential savings for borrowers How do I avoid paying the loyalty tax?

Why aren’t more people refinancing? Thursday, January 11 2024

A major frustration for property investors is having to reset their interest only investment loan every 5 years. If you have an investment loan you would be aware that most lenders only allow an interest only period of 5 years. After that it automatically converts to principal and interest repayments. Which can see your repayments jump by 20-30%. The only way to get your loan back on interest only is to go through the whole application process again with your current lender or try to refinance. Given the series of rate rises we have experienced this has become very difficult for many investors. The beauty of this loan is the IO period is 40 years. No reviews. No need to make additional payments. At expiry you can either pay the loan out from super or other funds or sale of the property. This means you have extra cash for other things like paying down your home loan, putting extra money into super, or even funds for another investment. Friday, April 24 2020

Wednesday, February 06 2019

Apartments and townhouses will no longer be developed in Brisbane’s suburbs zoned low-density residential. The call to “protect the Brisbane backyard” triumphed, with a vote passed by Brisbane City Council to remove provisions allowing for multiple dwellings on blocks of more than 3,000 square metres. Read full article here Wednesday, January 30 2019

Three non-major lenders have announced reductions to their mortgage rates of up to 32 basis points, despite out-of-cycle rate increases from competitors. If you are not relooking at your lending you are paying too much. If you want to start making some savings I have opened up my calendar for a FREE telephone appointment to see what you could save. Make a time with me now for an initial 10 minute telephone chat. |