|

Monday, February 05 2018

Friday, February 02 2018

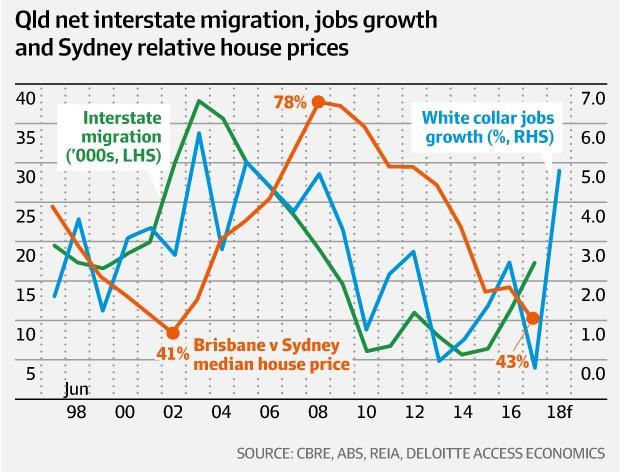

Queensland is in a historical sweet spot for home price growth with an analysis of interstate migration showing that the gap in home price between Sydney and Brisbane could soon start narrowing. In 2002, the median Brisbane home price equated to just 41 per cent of a Sydney home – a historical low. But interstate migration to Queensland started to surge, peaking in 2003 at about 40,000. Home prices started to rise as the interstate migration rose and the gap between median Sydney and Brisbane prices started to narrow. Brisbane home prices were able to reach as much as 78 per cent of a Sydney home price in 2008. CBRE researcher Ally McDade has analysed the numbers and highlights that the same process is starting to happen again. "At June 2017, levels of interstate immigration reached the highest quarterly and annual growth since 2008," she said, "Over the year to June 2017, interstate migration to Queensland increased by an impressive 50 per cent, or circa 17,500 persons." "As more people migrate to the Sunshine State, the equity wealth built in Sydney is transferred to Brisbane," Ms McDade said. "This increase in demand, coupled with a higher perceived value, has historically driven Brisbane real estate prices higher." Large and small developers in Queensland are noticing the interstate change. Stockland analysis shows that most interstate buyers to Queensland are coming from NSW, representing about two thirds of total interstate purchases in Stockland's south-east Queensland communities. Victorian buyers accounted for a further 12 per cent of interstate purchases, followed by South Australia (8 per cent) and the ACT (6 per cent). Friday, February 02 2018

Thursday, February 01 2018

The Consumer Price Index (CPI) rose 0.6 per cent in the December quarter 2017. Certainly no early RBA hike here! was Shane Oliver's immediate tweet. The CPI rose 1.9 per cent through the year to December quarter 2017 having increased 1.8 per cent through the year to September quarter 2017. Still beow the RBA's target band. Tuesday, January 30 2018

According to MacQuarie Bank it is now looking very likely that housing prices at the national level are again rising modestly. After seasonal adjustment, monthly growth in APM's measure of capital city dwelling prices has picked up modestly in recent months. And CoreLogic's data to mid-January shows a clear improvement in seasonally adjusted dwelling price growth, with the caveat that sales volumes in January are very low. Monday, January 29 2018

There are some life stage considerations involved in answering this question specifically. But for the sake of this discussion... Thursday, January 25 2018

The short answer is YES. It is possible to have a negatively geared property that completely pays for itself. Thursday, January 25 2018

Do you know where your financial future is heading? Do you know if you will be able to maintain your current lifestyle when you stop full time work? Monday, January 15 2018

Units are often a popular choice for first time investors as they are at a lower price point than houses for the same location and on the surface, can appear to offer better returns. Thursday, December 21 2017

This is why you need to relook at your investment loans.

But you can take a number of steps to improve your situation. There are still competitive investment rates available An investor with $750,000 in lending on a 5% interest rate could save approx. $9,450 per annum in interest. Look at principle and interest (P&I) repayments Fixing may also be an option Don’t limit your thinking to investment lending Don’t forget the fees Have your switching costs covered Cash positive property Have your situation reviewed To have your situation reviewed is easy. Just click on the button below to arrange an initial telephone appointment with me and let's start saving you some money.

|