|

Thursday, January 16 2014

This Boutique apartment complex has come up on our radar.

The units are complete What opportunities are you missing? Contact us for an initial discussion. What are the secrets you need to know before you start investing? Tuesday, January 14 2014

Raine & Horne are tipping 7% plus growth for Brisbane in the coming year. While Brisbane finished behind Sydney and Melbourne last year, they believe it is well-placed for a comeback with tight supply and growing demand. Raine & Horne’s general manager for Queensland, Steve Worrad, said that while activity has slowed over the holidays it’s often being reported as up 25% for the same time last year, with listings down by as much as 60%. “Property prices in the southern capitals enjoyed a robust 2013, with the median house price in Sydney, for example, between $665,000 and $712,000 depending on who you listen to, while the median house price in Brisbane is an affordable $445,000,” said Worrad. “This gives Sydney retirees, especially, scope to sell a family home tax-free, and make a lifestyle shift to Brisbane and add the difference to their retirement savings.” He noted a new listing of a two-bedroom modern apartment, 52/2 Masthead Drive, Cleveland, which they expect will fetch $300,000 to $320,000. RP Data notes that it previously sold in December 2011 for $262,000. “While attracting local interest, we’ve fielded enquiries from Melbourne-based retirees for this spacious apartment, which makes sense as it is located on the sought-after Raby Bay Marina, and has a beach at the end of the street and excellent river boardwalks,” he said. Fly In/Fly Out workers are also set to be a growing demographic in Brisbane, whether they’re working in the mines or investment banking, he predicted. Brisbane’s New Farm in particular was mentioned as a good performer over 2013, with days on market at just seven. This comes as confidence builds in Queensland economic sectors, with Australian Bureau of Statistics data seeing a 4.9% increase in trend dwelling approvals and a 0.5% increase in retail turnover during November of 2013. This may help increase the supply that Raine & Horne notes is currently lacking. Acting Treasurer and Minister for Trade, John McVeigh, said that they were cutting red tape and the cost of business to help maintain Queensland's job creation and speed up building approvals. “Importantly, this increase in trend dwelling approvals follows 23 consecutive monthly increases, with approvals now 50.6 per cent higher than December 2011," said McVeigh. “This figure was driven by private other dwelling approvals, such as townhouses or apartments, which were 78.4 per cent higher over the year and at their highest level on record in November 2013," he said. “We’re working steadfastly to grow the property and construction sector, implementing a $15,000 Great Start Grant as part of the 2012-2013 Budget which has already seen 4100 grants given to Queenslanders.” Tuesday, January 14 2014

First-home buyers are being attracted to affordable master-planned communities on the outskirts of Brisbane, according to the Real Estate Institute of Queensland and St George Bank. The Courier-Mail reported that North Lakes and Springfield head the list of outlying suburbs with a median house price below $450,000. North Lakes, 25km north of the Brisbane CBD, recorded 377 sales in the 12 months to September. Forest Lake and Springfield Lakes, 22km west, achieved 600 sales between them. St George Bank head of retail Ross Gillam says loan applications are up 20% across Brisbane's western corridor. "The region has huge potential for growth, with concentrations of employment, retail services, infrastructure and transport links," Gillam says. Thursday, January 09 2014

As is typical for this time of year the various commentators and researchers are making their predictions for the year ahead in property. General consensus seems to be for growth between 3 - 5% for capitals excluding Hobart. In a recent webinar Terry Ryder put Brisbane at the top of the tree at 10% for 2014. Based on what I am seeing already I share Terry's view Wednesday, January 08 2014

Just negotiated another 1% rate discount for a client. Another happy client. Contact us to discuss your home loan requirements Tuesday, January 07 2014

Hot off the press - New options located. Price Circa $445000 Estimated weekly rent up to $720* Dual income properties provide the investor with two rents instead of one and yet the build cost is roughly the same as a standard house. This means in most cases the properties will be cash positive. The properties have

When viewed from the road it appears to be a high-quality standard residential dwelling which means that it has been accepted by Queensland’s leading developers of owner-occupier land estates. It’s when you look at the floor plan that the revolutionary design becomes clear. What appears to be one dwelling is in fact two dwellings. There are minimal outgoings with only one set of rates and no body corporate fees. Because the dual dwelling is constructed of such a high standard, these are able to be constructed in owner- occupier dominated estates, helping to drive capital growth. Example Summary of Inclusions:

* Note different specifications may apply for this option. What opportunities are you missing? Contact us for an initial discussion. What are the secrets you need to know before you start investing? Tuesday, January 07 2014

2013 proved once again that fence sitting is a costly exercise. While many would be property buyers sat back and span their wheels waiting for the heard to jump into the market a handful of people took action and more than likely picked the bottom of the market. According to RP Data Brisbane house values increased by 5.3 per cent over 2013 compared and unit values 3.5 per cent. To put this in perspective a $400,000 property purchased 12 months ago at that rate of growth would now be $421,200. And if the growth rate is repeated in the next 12 months it will be $443,523. A number of independent researcher expect the Brisbane market to continue to grow over 2014 as it makes up time from a few years of subdued growth and it's relative affordability to the Sydney and Melbourne markets. What opportunities are you missing? Contact us for an initial discussion. What are the secrets you need to know before you start investing? Tuesday, January 07 2014

Demonstrating your ability to repay the loan is essential to successfully qualifying for a home loan. This means in one form or another you will need to demonstrate that after expenses such as living, and other financial commitments you have sufficient disposable income to meet loan repayments. Lenders have different attitudes towards certain types of income but there are many areas where they tend to be relatively consistent. This is particularly the case where a loan requires mortgage insurance. As many lenders will use the same mortgage insurer and therefore be subject to the same credit policy. The first thing you should be aware of is that the amount you can qualify for can vary significantly from lender to lender. Even between the major banks there can be significant variations. For example across a panel of over 30 lenders, a couple earning $75,000 per annum could potentially borrow anywhere between $235,000 to $512,000, based on the same information. This is because each lender has differing credit policies and formulas they use to determine your credit worthiness. So if you are only considering one or two lenders then you could be cutting yourself off from plenty of options. Employment Full time and permanent part time Lenders are looking for stability in employment. Generally at least 6 months in one job, and at least two years or more in the same industry. No probation. If you don’t have 2 years in the same industry then they will be looking for at least 12 months in your current position. If you have a history of changing jobs or professional on a regular basis then this could go against you. Casual Generally at least 12 months employment or 2 years in the same industry. Lenders may want to see 12 months worth of income to establish an average earning Self-employed or contract worker In almost all cases lenders will require you to be trading for a minimum of 2 years. For most businesses lenders will also require a registered ABN for 2 years. If an ABN can not be produced some lenders will accept a letter from your accountant confirming the business has been trading for 2 years. Working in a family business Most lenders will treat this the same as being self-employed and therefore will want to see a 2 years trading history for the business. Income In terms of income lenders are trying to establish regular and reliable sources of income. So if you are an employee, have been in your job for some time, and are paid the same amount week in week out then 100% of your based gross income will be considered. The areas where it becomes greyer are as follows: Overtime If overtime is standard for your industry (such as nursing) then most lenders will allow 100% to be included for servicing. It may however be necessary to provide additional documentation such as group certificates or a letter from your employer to confirm that overtime is a standard requirement of your job. If it is not industry standard then two years tax returns or group certificates plus a letter from your employer may be required. Commission/Bonuses Most lenders will generally want to see 2 years history of earnings if bonuses and commissions are part of your remuneration. If you have been employed for 12 months and commission is a condition of your employment then some lender may consider 100% if this can be documented. If you have been in your position for less than 12 months this it is likely only your base salary will be considered. Car allowances This varies quite considerably amongst lenders ranging from not at all to 100%. If the allowance can be cashed in then several lenders will allow 100% to be used. If not several lenders will at least allow it to be offset against any lease payments. So for example if your allowance was $10,000 and your vehicle lease payments were $8,000 per annum. Then the lease payments would not be included as part of your assessment. The remaining $2,000 however would not be added to your income. Some will lenders will only allow 50% to be used or will simply have a dollar cap that is applied. Self-employed and contract To establish your income, business and personal tax returns and financial statements will be required. Income/profit will generally be averaged over two years. Most lenders will allow add-backs for non-cash items like depreciation and non-recurring expenses. Rental income from investment property Lenders will generally use between 70-80% of the gross rental amount. Income must generally be confirmed from either a current lease agreement or rental statements. For newly acquired properties a letter from a real estate agent confirming the expected rental can often be used. Rent received from boarders Generally this type of income will not be accepted. Some lenders may consider it if tax returns can demonstrate that it has been earned consistently over a 2 year period. Dividends from investments or share trading Needs to be evidenced from 2 years tax returns Child maintenance Generally not accepted but will be considered by some lenders where there is a court order in place, the children are less than 10 years, and consistent payment over 12 months can be demonstrated. Centrelink payments 100% of the Family Tax Benefit will be considered in most cases where the children are less than 11 years of age. 100% of government pensions will be considered if they are ongoing and are evidence by relevant documentation. Unemployment benefits and New Start are generally not considered. You can see from above what you actually earn and what can be included for assessment can end up being quite different. The above of course is only general and what can and can’t be used will vary from lender to lender. Also as mentioned above some lenders serviceability calculators are more favourable than others. Contact us to discuss your home loan requirements or a for a review of your current lending.

Monday, November 04 2013

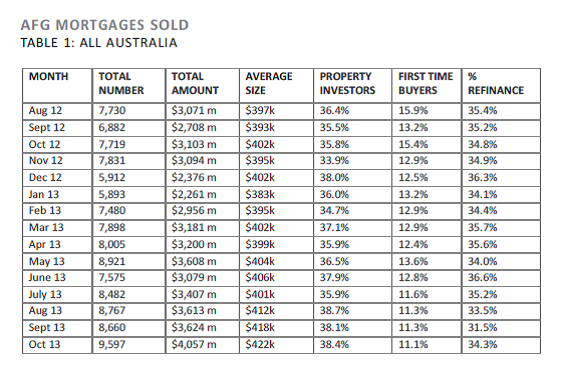

The latest mortgage index from Australian Finance Group (Australia's largest finance aggregator has shown a significant increase in activity with just over $4 billion in loans being written for October. Nearly $1 billion more than this time last year. Investment lending remains strong accounting for 38% of all loans written. The growth in lending is underpinning the increased activity we are seeing in the property market.

Thursday, October 31 2013

Suncorp Bank is reducing the rate to its all-in-one line of credit Access Equity by 0.10% p.a. As part of Home Package Plus# (≤80% LVR) $250,000 – $499,999 4.94%* p.a. $500,000+ 4.89%* p.a. Standalone rate $10,000+ 5.99%* p.a. Access Equity offers the following benefits:

Contact us if you would like to discuss this and othe finance options.

Cheers Greg Carroll

|