I believe the reason most people procrastinate is FEAR. They are afraid of the risks associated with investing. They focus on all the things that could go wrong “the what ifs” and console themselves that it is much safer to nothing.

This is however untrue, as doing nothing and delaying actually increases risk and increases the problem.

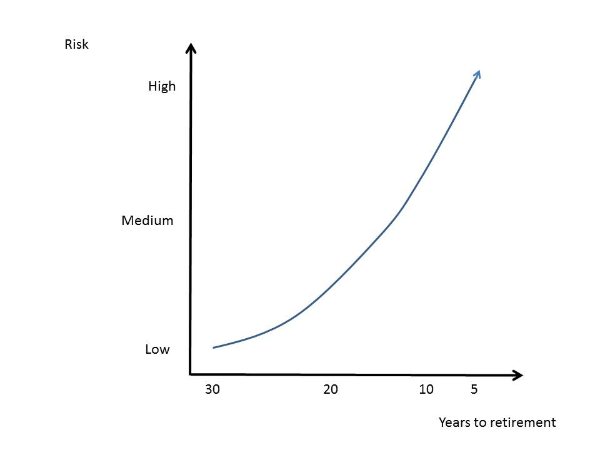

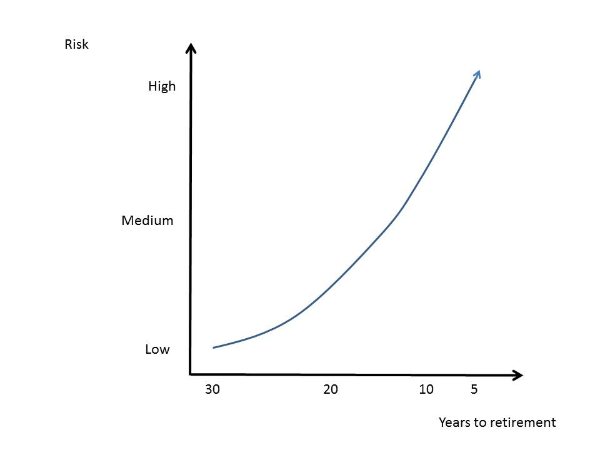

If you decided you needed $2 million by retirement would you sooner have 30 years to accumulate it or 5 years?

If you start early then you have a lot of time to build to this number which means your risk level is low. You can take small incremental steps and you will be less concerned and impacted by the markets ups and downs.

Investing earlier means your investments have the opportunity to go through a number of investment cycles. Think of each investment cycle as an opportunity to double your money. The more cycles you go through the more chances to double your money.

And if things did go “pear-shaped” you still have time to start and rebuild again.

If you wait to take action until 5 years before retirement then you have a very steep hill to climb in a short space of time. To achieve your target you will need to take a more aggressive investment approach, you will be vulnerable to market volatility and if things go wrong you will not have time to rebuild. So this is a high risk approach.

The longer we delay action we are actually putting ourselves in a position where we will need to take greater risk to achieve our goals.

Yet this is actually what most people to. They delay and defer until they don’t have a choice and then take on riskier investments with promise of higher growth or higher returns. And that’s how we end up with situations like Storm Financial and Banksia where people lose everything.

As the saying goes “The best time to plant a tree was 20 years ago. The second best time is today”.