|

Tuesday, January 15 2019

Solid economic fundamentals have positioned many of Queensland’s residential real estate markets for a good year ahead, with steady demand growth forecast due to rising population, improving employment rates and better lending conditions. Read the full article here Friday, January 11 2019

BRISBANE’S housing market has recorded the strongest annual rise in rents in three years. The latest CoreLogic data by realestate.com.au shows house rents increased 2.4 per cent in 2018, while the cost of leasing a unit became 2.6 per cent more expensive. With a pull back in development projects and an additional 66,500 new residents into the South East per annum this presents more good news for landlords seeking to increase yields. Particularly while the Brisbane market remains affordable.

Monday, January 07 2019

Some of the industry’s top heavyweights have shared their predictions for the state’s housing market in 2019 — and the forecast is sunny. Go here to read full article Monday, December 24 2018

According to the Real Estate Institute of Queensland’s Queensland Market Monitor a number of outer Brisbane suburbs reported a double-digit annual median house price growth in the range of 10 per cent to 17 per cent for the past year. Go here for full article Tuesday, December 18 2018

Monday, December 17 2018

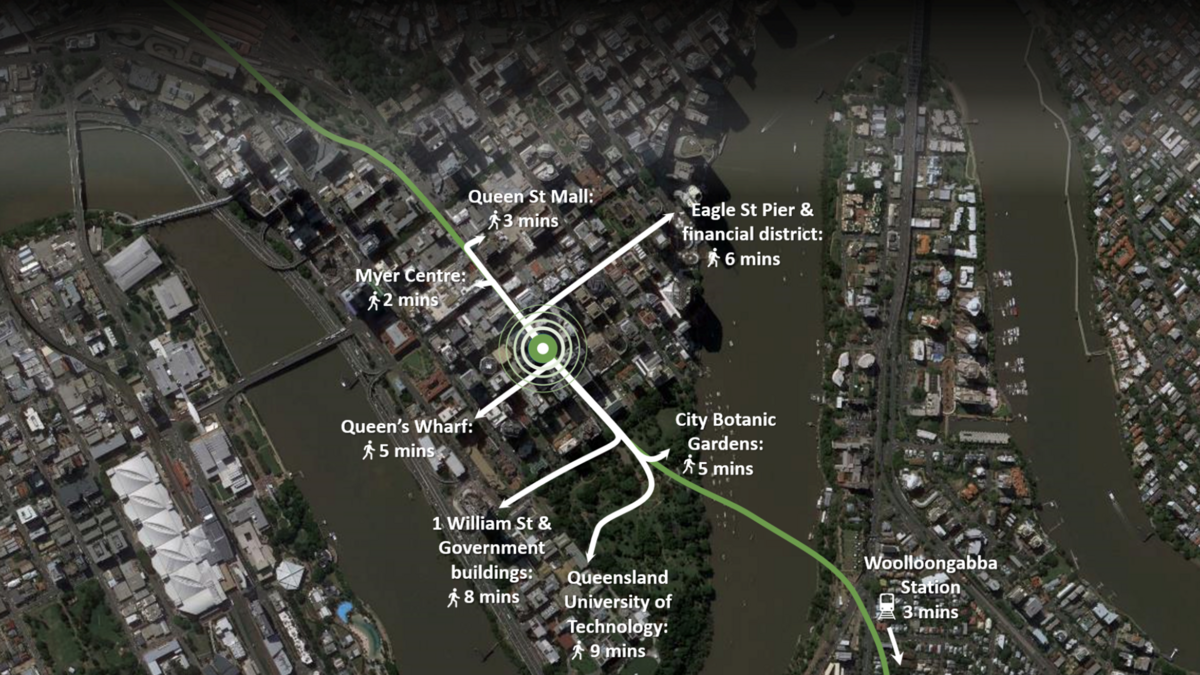

The Queensland government has declared a Cross River Rail Priority Development Area as it prepares to build a new underground station in the heart of Brisbane city. Go here for full article Wednesday, December 12 2018

A solidly performing southeast corner property market beat predictions of doom and gloom as Brisbane, the Sunshine Coast and the Gold Coast all posted record annual median house prices in the September quarter of the REIQ Queensland Market Monitor report. Read full report here Wednesday, December 05 2018

Here is how HTW's year in review describes Brisbane “Not surprising really – these locations are perennially strong performers,” the report said.Brisbane's middle ring also fired up in 2018 and remained desirable due to affordability and proximity to lifestyle nodes, infrastructure and public transport.Thanks to major infrastructure projects such as continued works on Queens Wharf and the Howard Smith Wharves, Brisbane gained a “more positive profile” in 2018. Friday, November 30 2018

Brisbane house prices are forecast to rise faster than any other capital city over the next two yearsFriday, November 23 2018

Or is that just wishful thinking? Irrespective of how much research and investigation you have done you cannot guarantee the amount of growth you will achieve or the time it will take to achieve it. Even if an area looks like it is about to take off and all the pointers are there. There is no guarantee that will happen. That's because many of the drivers of growth will be outside your control - you can't control the economy, government decisions, lender policy, business decisions, global markets, interest rates etc. You also don’t know when the market is going to hit the top and start declining. Look at Sydney which had enjoyed double digit growth for about 5 years. The heat has now come out of the market and prices are declining. Which means people who bought in the last 12 months in particular are now seeing their asset value slip. In most cases gains in property like any investment are going to happen over the long term. Sure, short term wins can happen but building your whole strategy around that would be more like speculation rather than investment. If you take a longer-term view, growth continues to be important but so does cashflow. You need to be able to afford to hold this property through all the ups and downs that the market and life might throw at you. If a property is costing little to nothing to hold or in fact fully paying for itself then holding over the longer term becomes much more manageable.

Thanks |