|

Tuesday, January 07 2014

2013 proved once again that fence sitting is a costly exercise. While many would be property buyers sat back and span their wheels waiting for the heard to jump into the market a handful of people took action and more than likely picked the bottom of the market. According to RP Data Brisbane house values increased by 5.3 per cent over 2013 compared and unit values 3.5 per cent. To put this in perspective a $400,000 property purchased 12 months ago at that rate of growth would now be $421,200. And if the growth rate is repeated in the next 12 months it will be $443,523. A number of independent researcher expect the Brisbane market to continue to grow over 2014 as it makes up time from a few years of subdued growth and it's relative affordability to the Sydney and Melbourne markets. What opportunities are you missing? Contact us for an initial discussion. What are the secrets you need to know before you start investing? Tuesday, January 07 2014

Demonstrating your ability to repay the loan is essential to successfully qualifying for a home loan. This means in one form or another you will need to demonstrate that after expenses such as living, and other financial commitments you have sufficient disposable income to meet loan repayments. Lenders have different attitudes towards certain types of income but there are many areas where they tend to be relatively consistent. This is particularly the case where a loan requires mortgage insurance. As many lenders will use the same mortgage insurer and therefore be subject to the same credit policy. The first thing you should be aware of is that the amount you can qualify for can vary significantly from lender to lender. Even between the major banks there can be significant variations. For example across a panel of over 30 lenders, a couple earning $75,000 per annum could potentially borrow anywhere between $235,000 to $512,000, based on the same information. This is because each lender has differing credit policies and formulas they use to determine your credit worthiness. So if you are only considering one or two lenders then you could be cutting yourself off from plenty of options. Employment Full time and permanent part time Lenders are looking for stability in employment. Generally at least 6 months in one job, and at least two years or more in the same industry. No probation. If you don’t have 2 years in the same industry then they will be looking for at least 12 months in your current position. If you have a history of changing jobs or professional on a regular basis then this could go against you. Casual Generally at least 12 months employment or 2 years in the same industry. Lenders may want to see 12 months worth of income to establish an average earning Self-employed or contract worker In almost all cases lenders will require you to be trading for a minimum of 2 years. For most businesses lenders will also require a registered ABN for 2 years. If an ABN can not be produced some lenders will accept a letter from your accountant confirming the business has been trading for 2 years. Working in a family business Most lenders will treat this the same as being self-employed and therefore will want to see a 2 years trading history for the business. Income In terms of income lenders are trying to establish regular and reliable sources of income. So if you are an employee, have been in your job for some time, and are paid the same amount week in week out then 100% of your based gross income will be considered. The areas where it becomes greyer are as follows: Overtime If overtime is standard for your industry (such as nursing) then most lenders will allow 100% to be included for servicing. It may however be necessary to provide additional documentation such as group certificates or a letter from your employer to confirm that overtime is a standard requirement of your job. If it is not industry standard then two years tax returns or group certificates plus a letter from your employer may be required. Commission/Bonuses Most lenders will generally want to see 2 years history of earnings if bonuses and commissions are part of your remuneration. If you have been employed for 12 months and commission is a condition of your employment then some lender may consider 100% if this can be documented. If you have been in your position for less than 12 months this it is likely only your base salary will be considered. Car allowances This varies quite considerably amongst lenders ranging from not at all to 100%. If the allowance can be cashed in then several lenders will allow 100% to be used. If not several lenders will at least allow it to be offset against any lease payments. So for example if your allowance was $10,000 and your vehicle lease payments were $8,000 per annum. Then the lease payments would not be included as part of your assessment. The remaining $2,000 however would not be added to your income. Some will lenders will only allow 50% to be used or will simply have a dollar cap that is applied. Self-employed and contract To establish your income, business and personal tax returns and financial statements will be required. Income/profit will generally be averaged over two years. Most lenders will allow add-backs for non-cash items like depreciation and non-recurring expenses. Rental income from investment property Lenders will generally use between 70-80% of the gross rental amount. Income must generally be confirmed from either a current lease agreement or rental statements. For newly acquired properties a letter from a real estate agent confirming the expected rental can often be used. Rent received from boarders Generally this type of income will not be accepted. Some lenders may consider it if tax returns can demonstrate that it has been earned consistently over a 2 year period. Dividends from investments or share trading Needs to be evidenced from 2 years tax returns Child maintenance Generally not accepted but will be considered by some lenders where there is a court order in place, the children are less than 10 years, and consistent payment over 12 months can be demonstrated. Centrelink payments 100% of the Family Tax Benefit will be considered in most cases where the children are less than 11 years of age. 100% of government pensions will be considered if they are ongoing and are evidence by relevant documentation. Unemployment benefits and New Start are generally not considered. You can see from above what you actually earn and what can be included for assessment can end up being quite different. The above of course is only general and what can and can’t be used will vary from lender to lender. Also as mentioned above some lenders serviceability calculators are more favourable than others. Contact us to discuss your home loan requirements or a for a review of your current lending.

Monday, November 04 2013

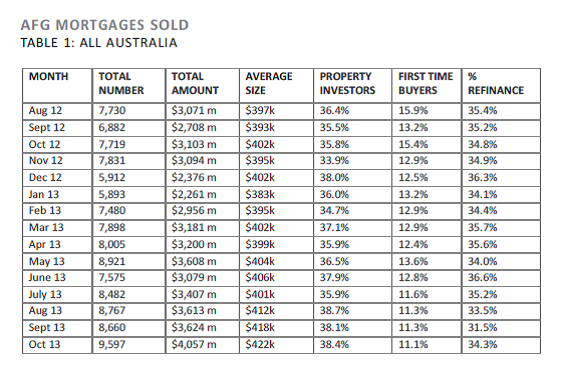

The latest mortgage index from Australian Finance Group (Australia's largest finance aggregator has shown a significant increase in activity with just over $4 billion in loans being written for October. Nearly $1 billion more than this time last year. Investment lending remains strong accounting for 38% of all loans written. The growth in lending is underpinning the increased activity we are seeing in the property market.

Thursday, October 31 2013

Suncorp Bank is reducing the rate to its all-in-one line of credit Access Equity by 0.10% p.a. As part of Home Package Plus# (≤80% LVR) $250,000 – $499,999 4.94%* p.a. $500,000+ 4.89%* p.a. Standalone rate $10,000+ 5.99%* p.a. Access Equity offers the following benefits:

Contact us if you would like to discuss this and othe finance options.

Cheers Greg Carroll

Thursday, October 31 2013

Understanding trusts…if that’s possible At their heart trusts are relatively simple but at first glance their function and purpose can be utterly confusing. I am going to give my best shot at explaining trusts but if you find yourself confused you are not alone.

I think the best way to understand a trust is to actually have one and see it in operation, but not everyone has that luxury. The important point to make at the outset is that trusts will not be for everyone.

So what is a trust? The trust deed spells out the powers, responsibilities, and limitations of the trustee. The trustee can be either a person or a company. In short the trustee is generally expected to manage the assets of the trust for the benefit of the trustees. Perhaps the most common form of trust is the discretionary trust. A discretionary trust means that the trustee has complete discretion how any income or assets of the trust may be distributed to the beneficiaries. The set up of this structure is best explained by way of an example. Bill and Jane Smith wish to purchase an investment property using a discretionary trust. They establish a trust called “The Smith Family Trust” with a company (Smith Investments Pty Ltd) as trustee. Both Bill and Jane are shareholders and directors of Smith Investments Pty Ltd and are also beneficiaries of the trust. The trust has all the powers of a natural person. So in essence Bill and Jane have complete control over the investment property and complete say over how any benefits coming from that investment can be distributed. But why would Bill and Jane choose a trust structure?

Asset protection For example let’s say you owned your home in your personal names but your investment property was owned through a trust with a company as trustee. Your tenant in the property slips on the stairs and decides to sue you for personal injury. In general terms the tenant would only be able to sue the trust and the company as trustee and would not be able to pursue your personal assets. If the property was worth $250,000 and the loan against the property was $260,000 then this would not make the trust an attractive target and may kill off any action. If however the investment property was owned in your name then this would open the door to your personal assets. This remains an area of contention and the laws on this are being reviewed all the time. So whether trusts remain a safe haven remains to be seen. In any case it would be wise to have landlords insurance with adequate public liability to protect you from such an event.

Estate planning A trust may also allow for a more tax effective distribution of assets to your family or other beneficiaries upon your death.

Tax planning

Referring to our example again. If Bill was a high income earner and Jane was not working then all income from the trust could be directed towards Jane so that any income is taxed at a lower marginal rate. Again if the trust sold the property and made a capital gain, that gain could be directed towards Jane. It can also provide an opportunity to defer payment of tax which can be of benefit to your cashflow.

Types of trusts

The discretionary or family trust This means that income can be distributed in one way in one year and in a different manner the next. Providing complete flexibility in managing tax.

The unit trust This structure may be appropriate where a number of friends or family wish to buy or develop a property but will be contributing differing amounts. Those who provide a higher level of equity would receive a larger number of units. The difference here however is that there is no discretion as to how income can be distributed. Any income earned by the trust must be distributed to beneficiaries according to the number of units they hold.

The hybrid trust Income can be distributed to beneficiaries according to their unit holding or at a later date income can be distributed at the trustee’s discretion. For example in the case of a capital gain.

Asset protection, greater flexibility with tax planning…all sounds good. But before you get too excited there are some potential downsides.

Negative gearing There can be a number of ways around this depending on your personal situation.

Using your business For example if you have a profitable business which is operating through a trust you can establish a separate trust for property investment. It is then possible to divert profits from the business trust to soak up losses in the investment trust. For example if your business trust made a profit of $100,000 and the investment trust made of loss of $10,000, then the business trust could distribute $10,000 to the investment trust to absorb the loss. The business trust would then only need to distribute $90,000 to the beneficiaries.

A hybrid trust A hybrid trust can also be effective. Under this scenario you borrow funds in your name which you use to buy units in the trust. The trust then pays cash to purchase the investment property. As long as the property is rented the trust should then be cash flow positive as it is not carrying the major expense of interest. Surplus income from the trust is then distributed to you, which can be offset against the interest on your loan.

Costs If you have a company as trustee then there will also be ongoing ASIC fees, and fees if you make any changes to directors or shareholders.

Land tax Lenders

In summary

What opportunities are you missing? Contact us for an initial discussion. What are the secrects you need to know before you start investing?

All the best Greg Carroll Friday, October 25 2013

Friday, October 18 2013

Repairs and maintenance is one of the main areas where there is a great deal of misunderstanding and ill-conceived plans by investors. read on Friday, October 11 2013

Depreciation can be one of the most significant drivers of cash flow for a property.

What are the secrects you need to know before you start investing?

|