Tuesday, December 02 2014

(SOURCE: CBA)

The average house in Australia is now worth over $75,000 more than at the same time two years ago, with a house in New South Wales (NSW) almost $100,000 more expensive than in any other part of the country.

New figures released today by the Australian Bureau of Statistics (ABS) showed the average house price in Australia during the September quarter was $563,100, up $76,700 on the median price of $486,400 recorded during the same period in 2012.

The data, which measured the price change in residential dwellings across the states, saw residential property prices up by 9.1% compared to a year ago, with NSW driving up the median price with the most expensive real estate in the country.

The average house price in NSW is now $681,900, compared to the lowest average house price of $312,000, which was found in Tasmania.

Over the September quarter the average price of a residential house increased across all the states except for Western Australia, where the price dropped slightly to $588,700.

Tuesday, December 02 2014

(SOURCE: First home buyer)

If you’re living with your parents, finding it tough to enter the property market, then you’re certainly not alone.

With property prices increasing, it’s becoming more common for multiple generations to live together in one home, according to QM Properties’ sales manager Damien Ross.

While many have heard of the granny flat, for keeping elderly relatives at the family home with their own privacy, it’s not quite as common to build a property from the ground up with a multi-generational family in mind.

“Young people are staying at home longer and often couples are living with their parents so they can save for their first home,” explains Ross.

The idea of living at home to save a larger deposit is compelling for many first timers and it’s likely that this will increasingly be the case should property prices continue to rise.

This trend is now so established that builders are creating homes designed specifically for multi-generational living, splitting properties into two separate homes with one common fire wall. They even suggest that the outside living areas could be divided with a wall, hedge or fence. With two kitchens, three or four bedrooms, three bathrooms and separate entries, it’s close to, but not quite, a duplex.

The home is not a duplex, it is still within Residential A zoning so there are no related council fees that come with duplex sites.

It’s expected that this type of home will become more common in areas with median prices out of reach for many buyers.

Thursday, November 06 2014

The most recent Real Estate Institute of Queensland (REIQ) statistics show that rental markets remain tight, with south-east Queensland’s Logan and Ipswich becoming strong rental hotspots for investors.

REIQ CEO, Antonia Mercorella, said that the latest Residential Rental Survey, conducted at the end of September, found that just four of Queensland’s 16 major regions recorded significant changes in vacancy rates.

She noted that this is evidence of a two-tier residential rental market across the state.

“Logan and Ipswich are emerging as the south-east’s rental hotspots as tenants move further afield from inner-Brisbane in search of more affordable rents,” Mercorella said.

“For the rent you’d pay for a three-bedroom house in Brisbane, you can get a four bedroom house in Brisbane’s outlying areas for up to $65 less a week.”

She noted that, for this reason, Logan and Ipswich are now very tight rental markets with the lowest vacancy rates in the Greater Brisbane region.

By the close of September, Brisbane City LGA recorded a 2.3% vacancy rate, relatively stable since the end of June.

“Brisbane’s middle to outer suburbs – those 5-to-20 kilometres from the CBD - recorded a slight easing in vacancy levels, up 0.2% to 2% at the end of September,” she said.

“The city’s inner suburbs, on the other hand, recorded a vacancy level of 2.9%, down from 3.4% at the end of June.”

The Residential Tenancy Authority’s records of median weekly rents for the September quarter also noted relatively steady rents across the LGA, with greater Brisbane returning to a vacancy rate seen 12 months ago – 1.7%.

“Vacancy levels in the Moreton Bay and Redland City council areas remained relatively steady over the three months to September, with both recording 1.8%,” she said.

“While not quite as tight as Logan and Ipswich, strong investor activity and tenant demand are setting the scene for competitive rental markets in both LGAs.”

Logan City’s vacancy rate currently sits at 1.5%, with Ipswich City at 1.6%, both down 1.4%.

SOURCE: Property Observer

Thursday, November 06 2014

Paying off debt is a good goal to have. But doing it to the exclusion of an investment plan will most likely see you well short of where you want to be in retirement.

It takes significant time to build substantial wealth, 20 - 30 years. So focusing just on clearing debt and hoping you can somehow pull it together in the last 5-10 years of your working life is going to see you come up well short.

But according to a new survey by REST Industry Super Australians are doing just that.

Only 15% of 35 to 49 year olds are prioritising long-term savings, while property debt is the dominant priority for this age group.REST Industry Super’s latest whitepaper, What’s Next, surveyed 1,000 Australians aged between 35 to 49 year on the state of their financial health.

Of the respondents, 71% are paying off a mortgage, which is their main financial aim. Long-term savings are the fourth highest priority, after paying off debt and short-term savings. Short-term savings, including holidays and education costs, was the top priority for those without mortgages.

REST CEO Damian Hill said that it’s encouraging to see this group take control of their immediate finances, including getting their mortgage under control. However, he said that it seems to be to the detriment of planning for the future.

“We know that relying solely on employer super contributions is unlikely to support the kind of lifestyle most Australians want in retirement, so it’s important to prioritise saving for post-work life as well,” Hill said.

“This is even more the case since the recent government announcement to delay the increase in the superannuation guarantee contribution rate to 12% until 2025.”

The 8% of respondents who owned their home outright prioritised retirement as their most important goal.

“Focusing on paying off the house means that over half (51%) of Australians are relying solely on the compulsory super system to save for their retirement – at the very stage of life when they are likely to be in the best position to make additional contributions on top of what their employer is paying,” Hill said.

“Planning for retirement doesn’t mean your mortgage has to suffer, but it is important to balance your financial priorities to ensure long-term savings aren’t being forgotten in the face of more immediate needs.”

However, some 6% of the respondents were saving for property in different ways. Of this small portion, some were using property investments, including their home, as a retirement plan.

Thursday, September 25 2014

Thursday, March 27 2014

As I discussed previously the biggest area of lending growth is investors. (refer graph below)

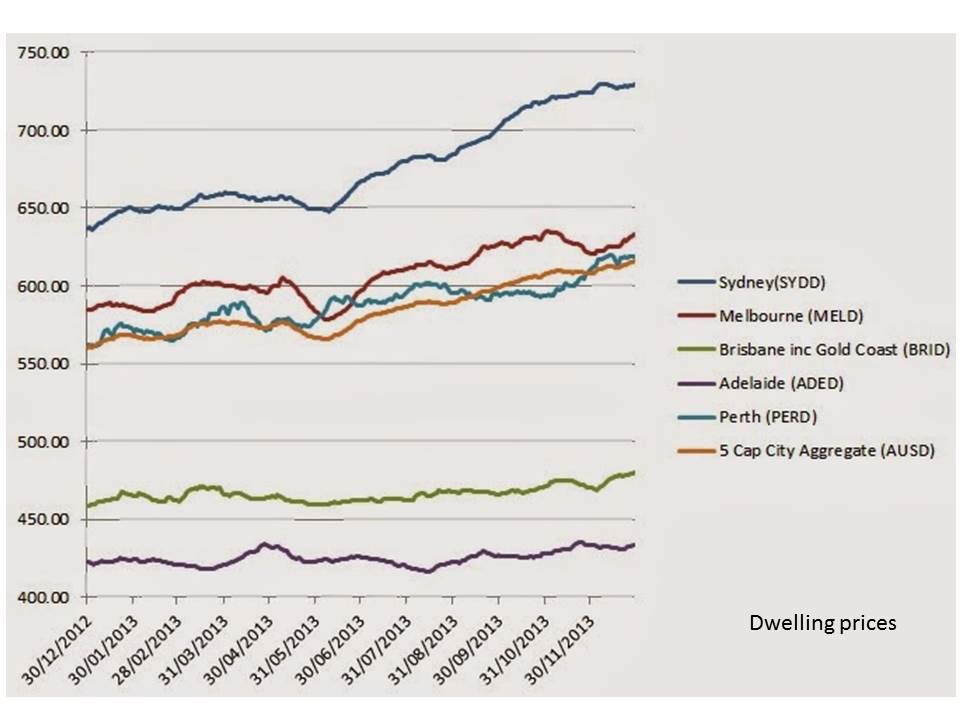

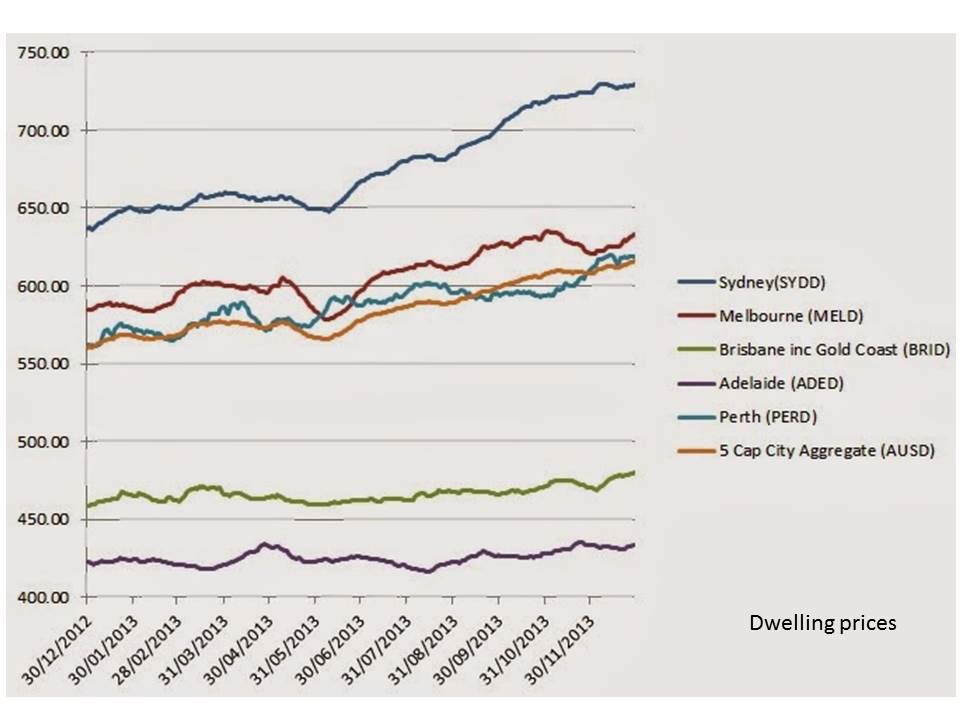

But which locations are likely to be in investors sights in 2014? We believe the below chart provides a bit of a clue.

Brisbane certainly presents an affordable option to investors when contrasted against the other major capitals and still appears in early stages of receovery.

The question is how can you take advantage? Where area the areas an opportunities that are likely to present good long term growth and deliver solid cashflow that will enable you to hold the property over the long term. Particularly if rates rise.

There's is no doubt many people will jump in head first but many will get it wrong.

Contact us to discuss how you can take advantage.

Thursday, March 27 2014

A question many have been asking is where are the first home buyers? With the Brisbane market in the early stages of recovery and interest low (normally favourable conditions) first home buyers still seem to be absent. Particularly when we look at the break up of housing finance below. .

But the figures may be a little bit misrepresented. First home buyers are entering the market not as owner-occupiers but as investors. More recent figures on lending growth show that the growth area in lending is in the investor market.

And it makes complete sense.

- The first home owners grant is no longer available for established property

- First time buyers can still get a foot in the market but have someone else help pay the mortgage while they continue to live at home and save or rent in locations that are close to their work or offer lifestyle benefits. Locations that would be out of their price range and budget from a buyer perspective.

- If the right type of property is purchased and structured correctly there are also significant tax benefits which are not achievable through own-occupied property.

We have had many clients utilise this approach as an effective way to building a property portfolio.

Contact us to discuss how you could get into the property market through investment

Tuesday, March 25 2014

Last year Australias population grew by almost 400,000 people mainly due to overseas migration. Contrast that to other developed nations - we are growing at around 1.8% per annum USA (0.8%); UK 0.6%; Canada 1%; China 0.6%

Our population is likely to grow by 10% over the next 5 years which means around 2.3 million more people will need somewhere to live.

That’s an awful lot of houses and apartments.

The latest Australian Bureau of Statistics (ABS) national population growth projections suggest our population is likely to double in the next 62 years.

Currently 57.3% of Australians live in our four big capital cities – Sydney, Melbourne, Brisbane or Perth but if the ABS population projections pan out, by 2061 65.8% of the total national population will live in our four big capital cities – Sydney, Melbourne, Brisbane and Perth.

Tuesday, March 25 2014

There are a range of offers in the market at present like the one below offering significant price discounts plus a range of other concessions. If you haven't reviewd your lending in a while now might be a good time. Contact us to arrange a finance review

Tuesday, March 25 2014

by Emily Guterras CBA

While many first home buyers may be struggling to get their foot on the property ladder, Gen Ys have no grounds to blame parents or grandparents, according to new research, which found that housing affordability has barely changed in a decade.

The median price of homes across Australia in the December quarter was $450,000, according to the RP Data/Rismark Home Value index, while the Australian Bureau of Statistics (ABS) national accounts estimate disposable income per household of $111,919.

The figures suggest that the median home price was around 4 times disposable income in the December quarter, up from 3.9 times in the September quarter.

However, over the past decade, the average household income has risen 70.6%, while house prices have gone up 66.7%.

"Gen Y has no reason to blame parents or grandparents - home affordability hasn't really budged in the past decade," said CommSec economist Craig James, who authored the research.

“Simply, Australians have got richer over time. But broadly over the decade little has changed in terms of home affordability – it has gone sideways.”

While low interest rates have contributed to a steep rise in house prices last year and early in 2014, the Reserve Bank of Australia does not believe that the present conditions pose a near term risk.

“Certainly homes are less affordable than 20 years ago, but that is not because income growth has been sluggish, but because wealthier Australians, utilising lower interest rates, and benefitting from more affordable basic necessities like food, clothing and transport, have channelled extra dollars into the family home," said James.

"Homes are bigger and of higher quality than 20 years ago.”

|