Thursday, November 06 2014

The most recent Real Estate Institute of Queensland (REIQ) statistics show that rental markets remain tight, with south-east Queensland’s Logan and Ipswich becoming strong rental hotspots for investors.

REIQ CEO, Antonia Mercorella, said that the latest Residential Rental Survey, conducted at the end of September, found that just four of Queensland’s 16 major regions recorded significant changes in vacancy rates.

She noted that this is evidence of a two-tier residential rental market across the state.

“Logan and Ipswich are emerging as the south-east’s rental hotspots as tenants move further afield from inner-Brisbane in search of more affordable rents,” Mercorella said.

“For the rent you’d pay for a three-bedroom house in Brisbane, you can get a four bedroom house in Brisbane’s outlying areas for up to $65 less a week.”

She noted that, for this reason, Logan and Ipswich are now very tight rental markets with the lowest vacancy rates in the Greater Brisbane region.

By the close of September, Brisbane City LGA recorded a 2.3% vacancy rate, relatively stable since the end of June.

“Brisbane’s middle to outer suburbs – those 5-to-20 kilometres from the CBD - recorded a slight easing in vacancy levels, up 0.2% to 2% at the end of September,” she said.

“The city’s inner suburbs, on the other hand, recorded a vacancy level of 2.9%, down from 3.4% at the end of June.”

The Residential Tenancy Authority’s records of median weekly rents for the September quarter also noted relatively steady rents across the LGA, with greater Brisbane returning to a vacancy rate seen 12 months ago – 1.7%.

“Vacancy levels in the Moreton Bay and Redland City council areas remained relatively steady over the three months to September, with both recording 1.8%,” she said.

“While not quite as tight as Logan and Ipswich, strong investor activity and tenant demand are setting the scene for competitive rental markets in both LGAs.”

Logan City’s vacancy rate currently sits at 1.5%, with Ipswich City at 1.6%, both down 1.4%.

SOURCE: Property Observer

Thursday, November 06 2014

Paying off debt is a good goal to have. But doing it to the exclusion of an investment plan will most likely see you well short of where you want to be in retirement.

It takes significant time to build substantial wealth, 20 - 30 years. So focusing just on clearing debt and hoping you can somehow pull it together in the last 5-10 years of your working life is going to see you come up well short.

But according to a new survey by REST Industry Super Australians are doing just that.

Only 15% of 35 to 49 year olds are prioritising long-term savings, while property debt is the dominant priority for this age group.REST Industry Super’s latest whitepaper, What’s Next, surveyed 1,000 Australians aged between 35 to 49 year on the state of their financial health.

Of the respondents, 71% are paying off a mortgage, which is their main financial aim. Long-term savings are the fourth highest priority, after paying off debt and short-term savings. Short-term savings, including holidays and education costs, was the top priority for those without mortgages.

REST CEO Damian Hill said that it’s encouraging to see this group take control of their immediate finances, including getting their mortgage under control. However, he said that it seems to be to the detriment of planning for the future.

“We know that relying solely on employer super contributions is unlikely to support the kind of lifestyle most Australians want in retirement, so it’s important to prioritise saving for post-work life as well,” Hill said.

“This is even more the case since the recent government announcement to delay the increase in the superannuation guarantee contribution rate to 12% until 2025.”

The 8% of respondents who owned their home outright prioritised retirement as their most important goal.

“Focusing on paying off the house means that over half (51%) of Australians are relying solely on the compulsory super system to save for their retirement – at the very stage of life when they are likely to be in the best position to make additional contributions on top of what their employer is paying,” Hill said.

“Planning for retirement doesn’t mean your mortgage has to suffer, but it is important to balance your financial priorities to ensure long-term savings aren’t being forgotten in the face of more immediate needs.”

However, some 6% of the respondents were saving for property in different ways. Of this small portion, some were using property investments, including their home, as a retirement plan.

Thursday, September 25 2014

Thursday, March 27 2014

As I discussed previously the biggest area of lending growth is investors. (refer graph below)

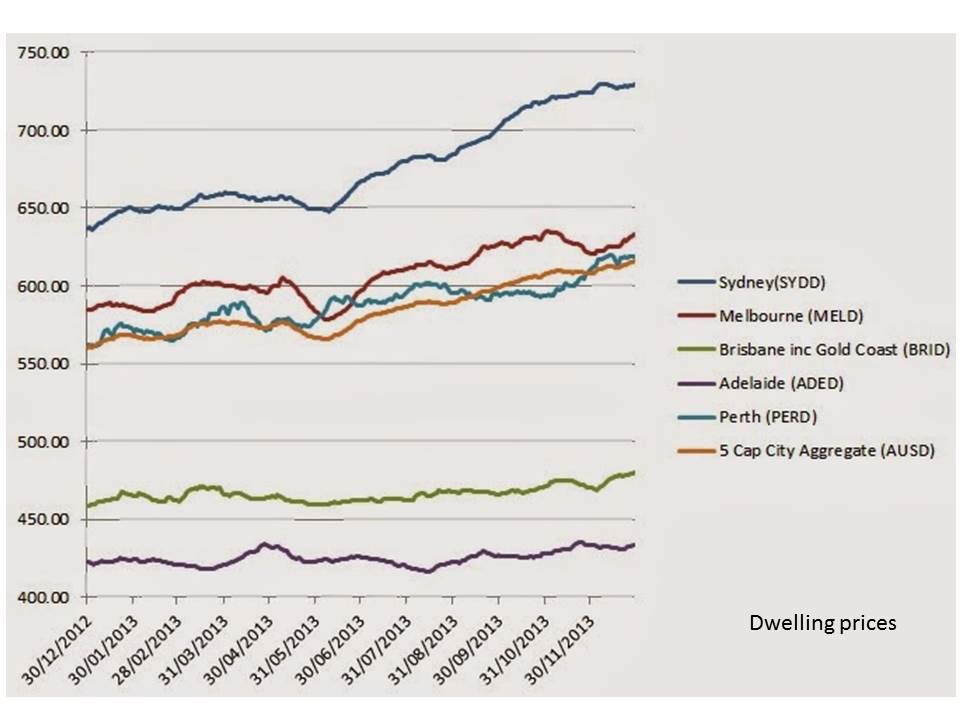

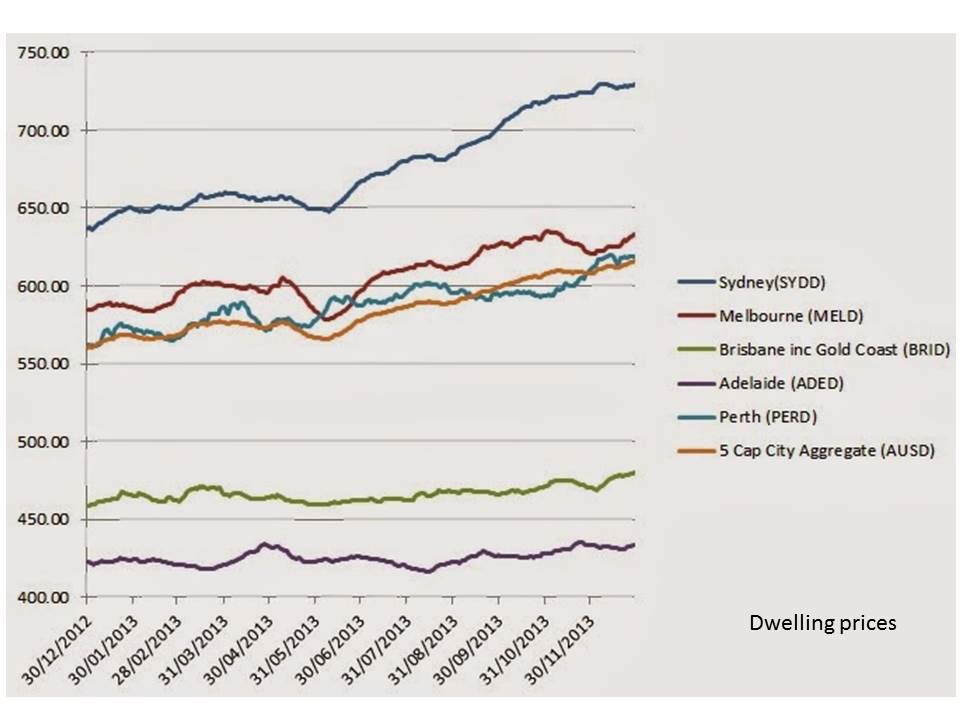

But which locations are likely to be in investors sights in 2014? We believe the below chart provides a bit of a clue.

Brisbane certainly presents an affordable option to investors when contrasted against the other major capitals and still appears in early stages of receovery.

The question is how can you take advantage? Where area the areas an opportunities that are likely to present good long term growth and deliver solid cashflow that will enable you to hold the property over the long term. Particularly if rates rise.

There's is no doubt many people will jump in head first but many will get it wrong.

Contact us to discuss how you can take advantage.

Thursday, March 27 2014

A question many have been asking is where are the first home buyers? With the Brisbane market in the early stages of recovery and interest low (normally favourable conditions) first home buyers still seem to be absent. Particularly when we look at the break up of housing finance below. .

But the figures may be a little bit misrepresented. First home buyers are entering the market not as owner-occupiers but as investors. More recent figures on lending growth show that the growth area in lending is in the investor market.

And it makes complete sense.

- The first home owners grant is no longer available for established property

- First time buyers can still get a foot in the market but have someone else help pay the mortgage while they continue to live at home and save or rent in locations that are close to their work or offer lifestyle benefits. Locations that would be out of their price range and budget from a buyer perspective.

- If the right type of property is purchased and structured correctly there are also significant tax benefits which are not achievable through own-occupied property.

We have had many clients utilise this approach as an effective way to building a property portfolio.

Contact us to discuss how you could get into the property market through investment

Tuesday, March 25 2014

Last year Australias population grew by almost 400,000 people mainly due to overseas migration. Contrast that to other developed nations - we are growing at around 1.8% per annum USA (0.8%); UK 0.6%; Canada 1%; China 0.6%

Our population is likely to grow by 10% over the next 5 years which means around 2.3 million more people will need somewhere to live.

That’s an awful lot of houses and apartments.

The latest Australian Bureau of Statistics (ABS) national population growth projections suggest our population is likely to double in the next 62 years.

Currently 57.3% of Australians live in our four big capital cities – Sydney, Melbourne, Brisbane or Perth but if the ABS population projections pan out, by 2061 65.8% of the total national population will live in our four big capital cities – Sydney, Melbourne, Brisbane and Perth.

Tuesday, March 25 2014

There are a range of offers in the market at present like the one below offering significant price discounts plus a range of other concessions. If you haven't reviewd your lending in a while now might be a good time. Contact us to arrange a finance review

Tuesday, March 25 2014

by Emily Guterras CBA

While many first home buyers may be struggling to get their foot on the property ladder, Gen Ys have no grounds to blame parents or grandparents, according to new research, which found that housing affordability has barely changed in a decade.

The median price of homes across Australia in the December quarter was $450,000, according to the RP Data/Rismark Home Value index, while the Australian Bureau of Statistics (ABS) national accounts estimate disposable income per household of $111,919.

The figures suggest that the median home price was around 4 times disposable income in the December quarter, up from 3.9 times in the September quarter.

However, over the past decade, the average household income has risen 70.6%, while house prices have gone up 66.7%.

"Gen Y has no reason to blame parents or grandparents - home affordability hasn't really budged in the past decade," said CommSec economist Craig James, who authored the research.

“Simply, Australians have got richer over time. But broadly over the decade little has changed in terms of home affordability – it has gone sideways.”

While low interest rates have contributed to a steep rise in house prices last year and early in 2014, the Reserve Bank of Australia does not believe that the present conditions pose a near term risk.

“Certainly homes are less affordable than 20 years ago, but that is not because income growth has been sluggish, but because wealthier Australians, utilising lower interest rates, and benefitting from more affordable basic necessities like food, clothing and transport, have channelled extra dollars into the family home," said James.

"Homes are bigger and of higher quality than 20 years ago.”

Tuesday, March 25 2014

Redeveloping parklands in the Gold Coast's Southport will be one of the most significant and largest urban renewal projects ever taken in the area, as part of the 2018 Commonwealth Games.

Premier Campbell Newman confirmed that an agreement had been made with Grocon to be the preferred developer of the 29 hectare site.

"The Commonwealth Games Village will provide essential services and accommodation for 6,500 athletes and officials in Games-mode and will be one of the Games’ most significant legacy projects," said Newman.

"This project will inject an estimated $500 million into the local economy over the next five years and will generate more than 1,500 jobs during its construction phase."

Newman released the Commonwealth Games Village Masterplan yesterday and the design includes more than 1,200 dwellings, including 1,171 one- and two-bedroom apartments and 82 townhouses, across more than 30 new buildings. These buildings will range from single to eight levels in height.

This community is expected to be retained after the Commonwealth Games.

"The developer’s approach is to create a tailored institutional investment vehicle to hold and rent the village dwellings after GC2018, with a gradual sell down over time. Approximately 12 hectares of land will be held by the state for future health and knowledge use," the masterplan details.

Other features include seven hectares of total green and open space and gardens, including a community park, over 6,000 square metres retail precinct and 12 hectares for future health and knowledge development.

Minister for Tourism, Small Business, Events and the Commonwealth Games, Jann Stuckey, said that it will be iconic after the games themselves have passed.

"It will create a great civic space that will no doubt become a focal point as the Gold Coast is propelled onto the international stage," said Stuckey.

"After the Games, Parklands will provide significant infrastructure as it becomes home to people and new businesses as part of a modern, mixed-used community which will include residential and a new business hub for health and knowledge, commercial and retail development."

Meanwhile, Grocon CEO, Carolyn Viney, said that they are thrilled to be part of the redevelopment and delivering value for the Gold Coast.

"Grocon’s design captures the essence of the sub-tropical environment of Queensland’s south coast with special attention being paid to sunlight, shading, natural air flows and water," said Viney.

"The urban and landscape design approach adopts the history and unique characteristics of the Gold Coast and its hinterland, intertwined with the role that water has played, and will continue to play, in shaping the Parklands site."

The masterplan has been submitted for development approval, with construction suggested to begin by early-2015.

Tuesday, March 04 2014

It is interesting to note that several lenders in the last week have reduced their 3 year fixed rates St George down to 5.14% and NAB 5.07%. Both ahead of the RBA board meeting today.

Perhaps they knew something as the interesting comment in the statement is the RBA's view on inflation "Inflation is expected to be consistent with the 2–3 per cent target over the next two years".

The Governor's statement below.

Glenn Stevens' statement from the March Reserve Bank meeting:

"At its meeting today, the Board decided to leave the cash rate unchanged at 2.5 per cent.

Growth in the global economy was a bit below trend in 2013, but there are reasonable prospects of a pick-up this year. The United States economy, while affected by adverse weather, continues its expansion and the euro area has begun a recovery from recession, albeit a fragile one. Japan has recorded a significant pick-up in growth, while China's growth remains in line with policymakers' objectives. Commodity prices have declined from their peaks but in historical terms remain high.

Financial conditions overall remain very accommodative. Long-term interest rates and most risk spreads remain low. Equity and credit markets are well placed to provide adequate funding, though for some emerging market countries conditions are considerably more challenging than they were a year ago.

In Australia, recent information suggests slightly firmer consumer demand and foreshadows a solid expansion in housing construction. Some indicators of business conditions and confidence have shown improvement and exports are rising. At the same time, resources sector investment spending is set to decline significantly and, at this stage, signs of improvement in investment intentions in other sectors are only tentative. Public spending is scheduled to be subdued.

The demand for labour has remained weak and, as a result, the rate of unemployment has continued to edge higher. Growth in wages has declined noticeably. If domestic costs remain contained, some moderation in the growth of prices for non-traded goods could be expected over time, which should keep inflation consistent with the target, even with lower levels of the exchange rate.

Monetary policy remains accommodative. Interest rates are very low and savers continue to look for higher returns in response to low rates on safe instruments. Credit growth remains low overall but is picking up gradually for households. Dwelling prices have increased significantly over the past year. The decline in the exchange rate seen to date will assist in achieving balanced growth in the economy, though the exchange rate remains high by historical standards.

Looking ahead, the Bank expects unemployment to rise further before it peaks. Over time, growth is expected to strengthen, helped by continued low interest rates and the lower exchange rate. Inflation is expected to be consistent with the 2–3 per cent target over the next two years.

In the Board's judgement, monetary policy is appropriately configured to foster sustainable growth in demand and inflation outcomes consistent with the target. On present indications, the most prudent course is likely to be a period of stability in interest rates."

|