|

Wednesday, July 17 2024

Tuesday, July 16 2024

Monday, July 08 2024

Thursday, July 04 2024

Wednesday, July 03 2024

Wednesday, July 03 2024

Tuesday, July 02 2024

One of lenders has updated their policy with some changes that benefit those on casual or commission income. Casually employed workers can use 100% of their casual income with no further shading. A minimum of 6 months of employment in the current role is needed, and we’ll annualise your income based on 52 weeks instead of 48. Only 6 months of history are needed to accept commission income, and we will annualise out the YTD income and shade to 80%. Looking for ways to improve your borrowing cacpacity? Book in a telephone appointment with me and I will show you how. Click here to go my calendar to make a time. Monday, July 01 2024

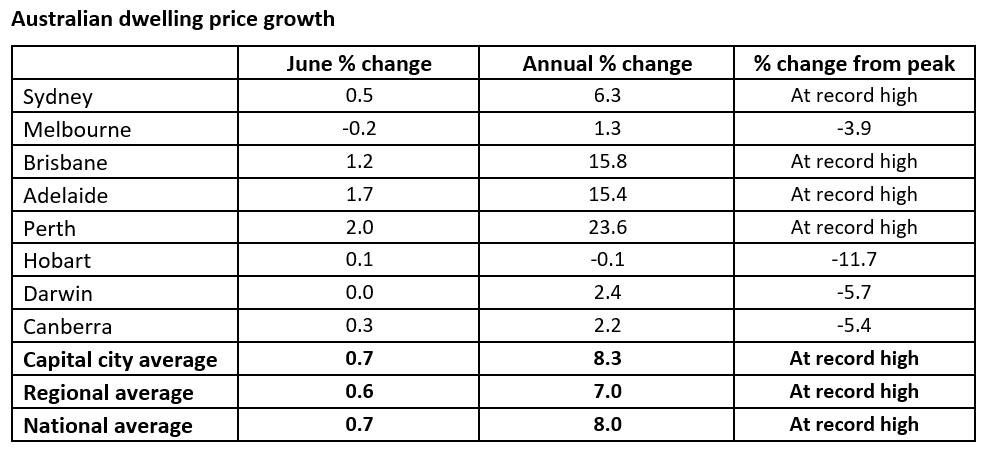

The monthly house price results from CoreLogic show national house prices rose another 0.7% in June, taking the annual growth to 8%. Perth (+2%), Adelaide (+1.7%) and Brisbane (+1.2%) had the strongest growth over the month, with Perth now up more than 23% over the year. Melbourne (-0.2%) was the only capital city to see house price soften.

Sunday, June 30 2024

Regional house prices are expected to hit record highs in almost all parts of Australia in the next 12 months, according to analysis by Domain. Sunday, June 30 2024

Growing demand for apartments means unit values are tipped to hit record highs in more suburbs in the coming months. |