|

What does marathon running have to do with investment?

by Greg Carroll Imagine if 6 months from today you were going to run a marathon - 42.195km. If you hadn't't done a lot of running before you would probably start your first week with just a few runs between 3-5 km and then steadily build your mileage over each successive week. At some point you would get more comfortable at running 10km then 15 km then 20km and then even out to 30km. During your training you might also join a running group or start getting some advice about how best to train, finding out the right things to eat and even some advice on how to approach the race. By taking it slow and steady you can handle the next step up as your fitness and strength has gradually improved and you are less likely to get injured. By the time you arrive at the start line you know it will still hard but you also know you have done all the work that will get you to the finish line. Imagine if instead for the first few months you did little or no training. Things got in the way like work, family commitments or it was a bit cold and wet.You keep telling yourself "I've got plenty of time. I'll start next week or after Christmas or after ....". Anyway time keeps ticking by and now you only have 2 months until race day. So now you start to panic a bit. You go out and try to run 10km "just to see where you are at" and can barley finish it and have to stop 3 times. Now you realise you are miles behind the 8 ball. So you decide from next week I'm going to start training and train really hard. So you do start pushing and start getting your miles up but then you get injured and have to stop training for 4 weeks. Now you only have a month to go and are pretty much back to where you started. You do start training again but take it a lot more steady because you can't afford to get injured and you start to build your miles up and find by race time you run at least up to 10km pretty well. And you find yourself saying "why didn't't I start training earlier I could have done so much better". As race day approaches you think about pulling out and maybe doing a shorter race. Either way you know you are well short of where you originally wanted to be. I see people take the exact same approach with investing and building wealth for their retirement.Many people delay, defer and make excuses to not start their investment plans - I'm too busy, I don't have time, I'll wait until after the election, until after Christmas, until the kids are back at school, until the kids finish school, in 6 months time - the list goes on. In my view these are all just excuses to cover up what is really going on which is FEAR. People are afraid of the risks associated with investing. They focus on all the things that could go wrong “the what ifs” and console themselves that it is much safer to nothing. This is however untrue. As was the case with the marathon, doing nothing and delaying action pushing you further away from your goals. And if you continue to defer and leave yourself a very short run up the you actually have to take on more risk if you still want to pursue them or you have to give up goal and accept something much less. Of course you could say but I don't have to run a marathon. That's true. But the thing that will happen to you is one day you will get old and one day you will not want to work as hard and one day you will not get paid as much if at all either by your choice or your employers. And what sort of life you end up having after that point will be determined by how you prepared for the that day. If you decided you needed $2 million by retirement would you sooner have 30 years to accumulate it or 5 years?

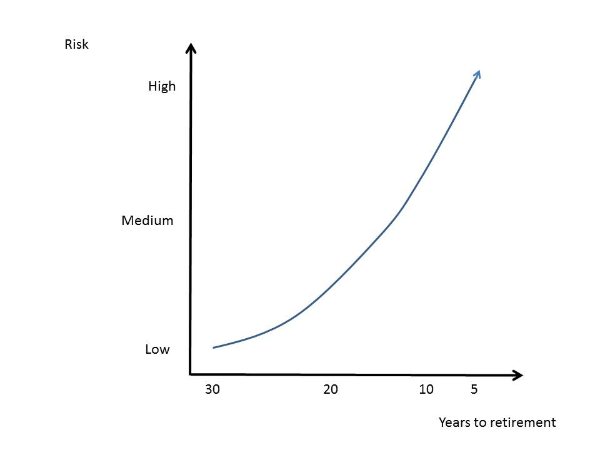

If you start early then you have a lot of time to build to this number which means your risk level is low. You can take small incremental steps and you will be less concerned and impacted by the markets ups and downs. Investing earlier means your investments have the opportunity to go through a number of investment cycles. Think of each investment cycle as an opportunity to double your money. The more cycles you go through the more chances to double your money. And if things did go “pear-shaped” you still have time to start and rebuild again. If you wait to take action until 5 years before retirement then you have a very steep hill to climb in a short space of time. To achieve your target you will need to take a more aggressive investment approach, you will be vulnerable to market volatility and if things go wrong you will not have time to rebuild. So this is a high risk approach. The longer we delay action we are actually putting ourselves in a position where we will need to take greater risk to achieve our goals. Yet this is actually what most people to. They delay and defer until they don’t have a choice and then take on riskier investments with promise of higher growth or higher returns. And that’s how we end up with situations like Storm Financial and Banksia where people lose everything. As the saying goes “The best time to plant a tree was 20 years ago. The second best time is today”. |