|

To Fix or Not to Fix To fix your interest rate (lock in) or not to fix your interest rate, that is the question. It's a question that many of us battle with periodically and the decision can be worth thousands to us either way so let's look at it. We certainly have had a rollercoaster ride in the last 15 months with interest rates. There was four rate increases in five months from election time (Nov '07) through to March '08. Funnily enough this coincided with the sustained drop in world share markets. The reasoning was to stomp on inflation according to the reserve bank governor Glen Stephens. Controlling inflation is important because "it preserves the value of money. In the long run, this is the principal way in which monetary policy can help to form a sound basis for long-term growth in the economy (ref:www.rba.gov.au). The reserve bank of (a) the stability of the currency of

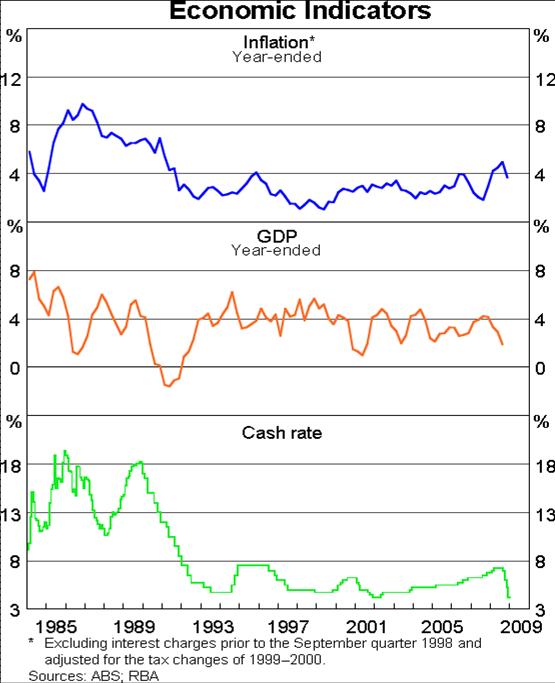

Put simply, there is a negative correlation between interest rate movements and inflation/economic growth - interest rates up, inflation and growth down and vice versa. In fact, since an inflation target was introduced in 1993, the dramatic peaks and troughs in inflation and hence growth or recession have lessened significantly. This equates to governments and the Reserve Bank learning from lessons past and controlling things quite well. Now that we know why interest rates change, let's look at where we are on the interest rate cycle (yes, interest rates go in a cycle. Once we know this and then find out where we are on that cycle, we are in a better position to make an educated assessment as to the direction of interest rates), so let's have a look...

The term Cash Rate' can be roughly interchanged with Interest rate and we can see that we had a steady rise in interest rates from 2002 until March 2008 which roughly coincided with steady economic growth and prosperity (notwithstanding the market contraction from December 07 onwards when the R.B was anomalisticly raising interest rates in the face of rapidly falling share prices). Clearly we are now in a "falling interest rate" environment or part of the cycle. Our next question is "How Low and for How Long?" The answer is "We can't predict the Future", but we can look at history and existing data to form a view. Last year the R.B. was raising interest rates to curb inflation and growth. Now, because of those interest rate hikes and the world economic downturn, the R.B. is cutting interest rates to stimulate growth. This creates our low/falling interest rate environment and will stay with us until growth fuels inflation enough to make the R.B. increase rates to control growth. We can utilise economic indicators to give us a clue. For example:

As Inflation and GDP (Gross Domestic Product or Growth) fall so do interest rates so as not to completely strangle' the economy and naturally the reverse is true Next, we can look at what the futures markets think as well as the deposit rates that your local bank is offering. What are the short, medium and longer trends? Over what time frame? This will help us with assessing future trends So what's the answer then? In a falling interest rate environment it is obviously unwise to lock in = don't fix. Next look for the change in direction of the indicators, inflation, growth and bank bill or deposit rates. When they start to go up and the trend looks like a sustained trend then speak to your advisor and "Lock it in, Eddie!" Before you lock in, ask your lender to do the calculation to unlock so that you know what you might be in for. Be prepared - it could be thousands. So when you think about fixing, make a wise, considered and educated decision. For more information paul@southerncrossfs.com.au or phone 07 5444 8332. Paul David GILLMORE DFS Southern Cross Financial Services

|